18h05 ▪

4

min read ▪ by

When a project touted for its massive adoption collapses under market pressure, the signal is strong. The PI token of Pi Network fell by 22%, reaching $0.61 on May 31, 2025. This plunge comes as the overall crypto market lost more than $170 billion in one week. The scale of the decline now raises questions about the project’s viability and the confidence that its longstanding investors can still place in it.

In Brief

- The PI token of Pi Network dropped 22% in one week, hitting a low of $0.61.

- This decline is part of a broader pullback in the crypto market, with $170 billion in market cap lost.

- The BBTrend indicator shows -4.52, signaling a strong persistent bearish momentum around the PI token.

- The Pi Network project finds itself at a critical moment, amid growing distrust and uncertainty about its trajectory.

A 22% Crypto Drop Amid Widespread Tension

Pi Network continues its free fall after falling below $1. The PI token recorded a notable 22% drop over the past seven days, settling at $0.61 on May 31. This correction fits into a broader trend marked by a global contraction in the crypto market.

Such a fall reflects an intensification of bearish sentiment on the project. The native token of Pi Network plunged 22% over the past week and continued its downward trend to reach a seven-day low at $0.61.

This performance coincides with a loss of more than $170 billion in market capitalization across the entire crypto market in one week, reflecting a climate of widespread distrust.

Several factors increase selling pressure on the PI token, including:

- A lack of recent positive catalysts around the Pi Network project;

- A persistent absence of official listing on major exchange platforms, limiting liquidity and access for institutional investors;

- A bearish macro context, with a fall of more than 5% in total crypto market capitalization in one week;

- A visible loss of confidence among holders, reflected in intensifying sales in recent sessions.

In this climate of widespread withdrawal, Pi Network appears particularly vulnerable, lacking solid technical support or a fundamental lever to contain the erosion of its value.

Technical Indicators in the Red: Pressure Intensifies

On-chain data reinforce this worrying observation, with a clearly bearish market dynamic.

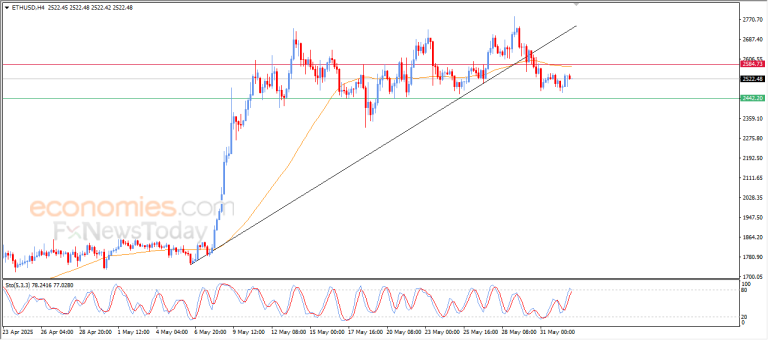

The BBTrend indicator, which measures the intensity and direction of a price movement based on the relative position of the price to Bollinger Bands, currently shows a value of -4.52.

The BBTrend continues to print red bars on the histogram, a clear signal of growing bearish momentum. This technical setup suggests that the PI price regularly closes near the lower band, typical of a market dominated by sellers.

Another alarming sign comes from the Smart Money Index (SMI), which is also declining. This indicator, used to track institutional investor behavior, shows a significant withdrawal of so-called “smart” money.

The PI SMI has dropped in recent days, signaling an exit of institutional investors. The disaffection of these players, often seen as market anticipators, heightens fears of a continued correction.

If sales continue, the PI token could break the technical support at $0.55. Thus, in the absence of sufficient buying reaction, the token could undergo a more pronounced correction and fall back to its historical low of $0.40. This prospect would have implications for PI holders as well as for the project’s overall image. Conversely, a demand rebound could allow a return toward $0.86, but this scenario remains hypothetical as long as the current momentum does not reverse.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d’une certification consultant blockchain délivrée par Alyra, j’ai rejoint l’aventure Cointribune en 2019.

Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l’économie, j’ai pris l’engagement de sensibiliser et d’informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu’elle offre. Je m’efforce chaque jour de fournir une analyse objective de l’actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.