- Ethereum ETFs saw $285 million in inflows, showing institutional confidence after months of outflows.

- Positive Funding Rates and strong futures activity suggest bullish sentiment, but macro risks remain in play.

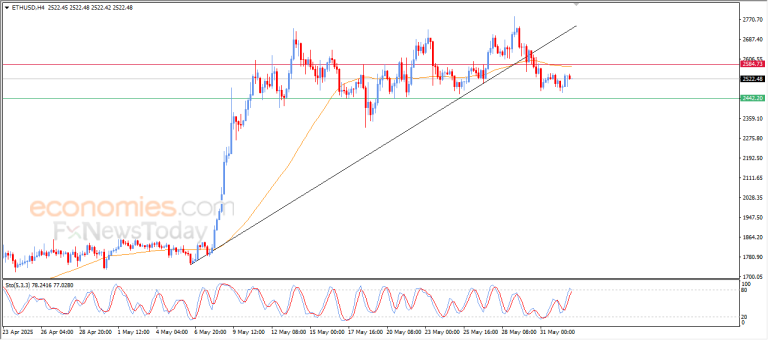

Ethereum [ETH] is gaining ground. Since mid-May, Ethereum ETFs have recorded a steady rise in weekly inflows, showing institutional interest.

Combined with persistently positive funding rates, the king altcoin appears poised for continued upward momentum.

But with the U.S. Federal Reserve’s FOMC meeting looming on the 17th of June, uncertainty could complicate Ethereum’s bullish trajectory.

Can ETH sustain its momentum, or will external pushes slow it down?

ETF inflows bounce back after prolonged outflows

After months of persistent outflows, Ethereum ETFs have seen a sharp turnaround, registering $285.84 million in net inflows over the past week alone.

This marks the third consecutive week of positive inflow momentum, a stark contrast to the heavy red seen from February through mid-April.

The reversal began in late April, gaining strength in May as total net assets climbed to $9.45 billion. While Ethereum’s price remains subdued, the influx of capital shows rising institutional confidence.