Ripple’s latest blog post about RLUSD’s use case in the Hidden Road setup has triggered concerns among XRP proponents, questioning the coin’s role in the deal.

On Tuesday, Ripple published a blog post highlighting the use case of stablecoins like RLUSD. The San Francisco-based payments company emphasized that stablecoins bridge the gap between DeFi and TradFi.

RLUSD’s Role in Hidden Road Setup

The blog post further highlighted RLUSD’s role in the Hidden Road deal. Recall that Ripple reached an agreement with Hidden Road to acquire the prime broker for $1.25 billion.

In its recent blog post, Ripple stated that Hidden Road, which clears over $3 trillion for 300 financial institutions annually, will leverage RLUSD as a collateral asset across its prime brokerage platform.

Meanwhile, part of the deal would see Hidden Road transition its post-trade activities onto XRPL, XRP’s underlying blockchain, allowing it to reduce costs. With XRPL handling Hidden Road’s post-trades, the prime broker would leverage XRP to pay all post-trade transaction fees.

The company initially disclosed this in April when it announced the Hidden Road acquisition. At the time, the disclosure elicited major controversy, with some community members expressing concerns about the company sidelining XRP.

Community Asks About XRP Role in Hidden Road Deal

These concerns have resurfaced with Ripple reiterating that Hidden Road will use RLUSD as a collateral asset across its platform.

Several users have once again questioned XRP’s role in the Hidden Road setup, with some suggesting that XRP’s function is now limited to paying transaction fees.

Earlier this month, XRP community member Elena Schoen echoed this sentiment on X. She indicated that while RLUSD’s utility spans cross-border settlements to multi-fiat onboarding, XRP is used to settle transactions only on the XRP Ledger (XRPL).

According to her, XRP was once the preferred bridge asset on XRPL. However, she suggested that the coin is gradually losing its relevance, alleging that RLUSD is gaining traction as Ripple’s favorite.

For context, Ripple launched the USD-pegged stablecoin on the XRPL in December 2024. After its launch, it was integrated into Ripple’s payments solution, giving financial institutions access to a fiat-backed digital currency with zero volatility.

Since its launch, RLUSD has gained widespread adoption across the broader crypto market and has been listed on major exchanges like Gemini, Uphold, Bitso, and MoonPay. Interestingly, thanks to the Hidden Road acquisition, it is now poised to become the first stablecoin to enable cross-margining between traditional markets and digital assets.

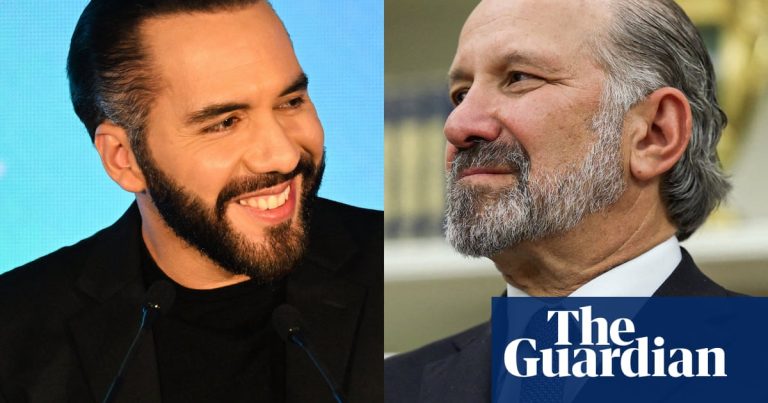

Ripple Execs Dismiss Concerns

While XRP proponents are concerned that RLUSD is gradually replacing their favorite coin, Ripple executives have continued to dismiss this assertion.

Earlier this year, Ripple CEO Brad Garlinghouse said RLUSD and XRP would complement each other. He asserted that both have different functions, noting that while XRP functions as a bridge asset to provide liquidity between two fiat currencies, RLUSD serves as an on-chain fiat.

Additionally, Ripple CTO David Schwartz stated that RLUSD is good for XRP rather than harmful. He emphasized that stablecoins like RLUSD are crucial in maintaining price stability. The Ripple CTO also mentioned that XRP would continue to render key functions like auto-bridging that favor its liquidity.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.