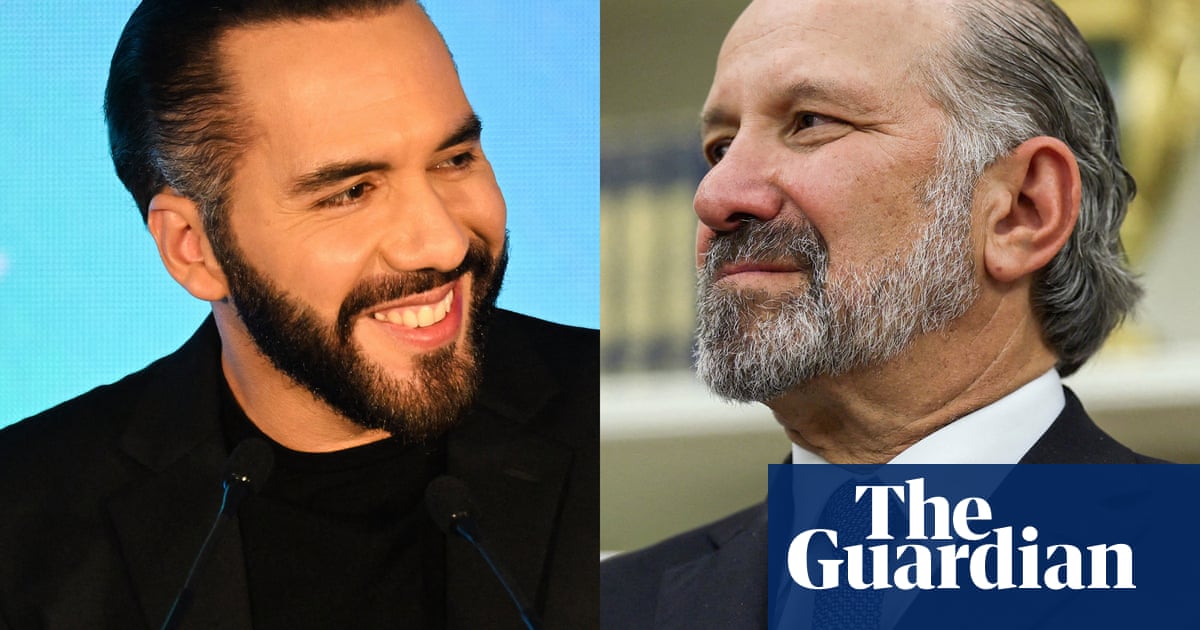

Trump administration’s commerce secretary, Howard Lutnick, and his family have had extensive business interests linked to El Salvador, whose authoritarian leader Nayib Bukele has grown close to the White House and who has courted controversy by imprisoning people deported from the US in an immigration crackdown.

El Salvador also plays host to a booming cryptocurrency and new media industry, which has numerous ties to Donald Trump allies who are seeking to make money from various ventures which have sometimes drawn the attention of authorities or ethics watchdogs.

Securities and Exchange Commission and Office of Government Ethics (OGE) filings, along with public records in the US and El Salvador, indicate that Cantor Fitzgerald, the firm Lutnick headed until weeks ago before handing off to a management team including two of his sons, holds an effective 5% stake in the cryptocurrency firm Tether, has negotiated several investments on behalf of the highly profitable company, and is custodian of the US treasury holdings from which those profits arise.

The Guardian contacted the commerce department’s public affairs office seeking comment from Lutnick on this reporting and received no response.

One of Cantor’s investments was a $775m purchase of shares in Rumble, a Trump-aligned video platform, in a deal that closed in February. Just ahead of that deal closing, Rumble inked another deal to provide cloud services to El Salvador’s government, with Bukele’s regime saying the arrangement rested on shared values of “freedom, innovation and prosperity”.

As well as facilitating the buy – which allowed Rumble insiders to cash out with nine- and 10-figure windfalls – Cantor has been a longterm investor in Rumble since it sponsored the special purpose acquisition company (Spac) that took the platform public.

Tether relocated to El Salvador in January, where the regime allows crypto firms to operate tax- and regulation-free – and has taken advantage of further tax breaks to accumulate real estate in downtown San Salvador alongside transplanted US crypto influencers and members of Bukele’s family.

New York Times reporting this week revealed some of the relationships previously scandal-plagued for Tether have become more palatable in Washington during the Trump administration, but not the extent of the company’s ties to El Salvador.

Cantor and Lutnick’s El Salvador deals raise further questions about the Trump administration’s deepening involvement with Bukele’s authoritarian regime, which has imprisoned 2% of its population during a two-year “state of exception”, which has consolidated Bukele’s power during a harsh crackdown on criminal gangs.

They also raise questions about the direction of cryptocurrency regulations after Tether’s founder, Giancarlo Devasini, reportedly told associates in November that Lutnick would “use his political clout” to lift the regulatory scrutiny that has plagued the troubled firm for almost a decade.

Tether

Tether – which reportedly mints the world’s most traded cryptocurrency – has attracted controversy since it was founded in 2014 alongside sister company Bitfinex, a cryptocurrency exchange by Devasini, an Italian former cosmetic surgeon who has relocated to El Salvador.

Increasingly, it also attracted hostile attention from US regulators. As recently as October, the Wall Street Journal reported that the Manhattan US attorney’s office was investigating Tether for its use in sanctions busting, money laundering, and “to fund illegal activities such as the drug trade, terrorism and hacking”.

That was the 19th time that Tether had attracted US government action, according to reporting at Protos, a cryptocurrency watchdog outlet. Many previous investigations and prosecutions alleged a fundamental fraud at the heart of Tether’s business.

The main product, USDT, is a stablecoin, a cryptocurrency whose value is exactly equivalent to that of the US dollar.

As the name implies, stablecoins are intended to offer a stable reservoir of value amid the volatility of crypto markets, allowing investors to trade, invest and transfer funds in dollar-equivalent values.

Its dollar equivalence is purportedly secured by an amount of US dollars, or easily converted equivalent assets, so that any holder can convert their USDT into dollars at any time. In theory, the company derives its profits from interest on the holdings that back its cryptocurrency.

But cryptocurrency traders, critics, government agencies and law enforcement have persistently questioned whether Tether holds reserves equivalent to the USDTs it has issued.

In 2021, Tether and Bitfinex agreed to jointly settle a Commodity Futures Trading Commission (CFTC) suit with a payment of $42.5m, with $41m of that coming from Tether.

In their statement on the fines, CFTC said: “From at least June 1, 2016 to February 25, 2019, Tether misrepresented to customers and the market that Tether maintained sufficient U.S. dollar reserves to back every USDT in circulation.”

Instead, the statement said: Tether had “relied upon unregulated entities and certain third-parties to hold funds comprising the reserves; co-mingled reserve funds with Bitfinex’s operational and customer funds; and held reserves in non-fiat financial products”.

The same year, they had paid $18.5m to the New York attorney general’s office to settle a suit that foreshadowed the circumstances surrounding the collapse of cryptocurrency exchange FTX. The attorney general’s office alleged that Tether had commingled client and corporate funds to cover up an $850m shortfall in their reserves.

As part of the settlement, Tether and Bitfinex were not required to admit wrongdoing.

In January, Protos reported in summary that the company had “lied repeatedly about the quality and quantity of its backing”.

The company has also resisted compliance with regulations designed to ensure that stablecoins including USDT have sufficient backing.

Tether is not currently listed on European exchanges because of the company’s refusal to comply with the European Union’s Markets in Crypto-Assets (Mica) framework, effective from 1 January. It requires stable issuers operating in Europe to obtain authorization as an electronic money institution, and to hold at least 60% of their reserve assets in European banks.

Other allegations have probed Tether’s knowledge and involvement in the use of the token in illicit activities like sanctions busting and trafficking.

Ricardo Valencia, an assistant professor at California State University, Fullerton, and a former staffer at the Salvadorian US embassy under a previous administration, said that the growing relationship between Tether and the Bukele regime was unsurprising.

While the Trump regime was exploiting the “crypto gulag horror movie” of Cecot, a destination of summarily deported immigrants under Trump, both the US administration and Tether were exploiting the fact that “you can pay the Salvadoran government to do shady deals for a fee,” Valencia said.

Lutnick and Tether

The extent of Lutnick’s relationship with Tether only fully came to light during his confirmation hearings in January, when US senators including Democrat Elizabeth Warren sought to shed light on how entwined Lutnick’s business affairs were with the cryptocurrency firm.

On 27 January, just ahead of those hearings, Warren sent a letter to Lutnick that in part said: “Your deep involvement with and support for Tether, a known facilitator of criminal activity that has been described as ‘outlaws’ favorite cryptocurrency,’ raises concerns about your judgment and ability to put the interests of the American people ahead of your own financial interests.”

In the hearings, Lutnick disclosed that a 2024 deal gave Cantor a convertible bond equivalent to a 5% stake in Tether, whose value he put at $600m. Meanwhile, according to the Wall Street Journal, Cantor “holds most of Tether’s $134 billion in assets, largely US Treasury bills, in exchange for tens of millions of dollars in fees each year”.

The relationship began at a time when Tether was in perhaps its deepest crisis. After they had paid the combined $61m in settlement funds to the New York attorney general and CFTC, Tether’s Bahamian bankers lost their ability to process international payments, cutting them off from customers. Reportedly, an investment adviser from their original bank connected them to Lutnick.

According to the Wall Street Journal, Lutnick personally traveled to meet Devasini, the Tether founder, in the Bahamas in late 2021 to determine whether the company had the assets it claimed to have.

Last July, he told a crypto conference that at that time, “I said: ‘Show me the money’”, and that “we found every penny, and they had every penny, but they had it in what I would call some pretty godforsaken places.”

Previous reports have suggested that at times, Tether’s backing has carried significant proportions of so-called “commercial paper”: undertakings from other companies to repay loans at a future date.

Cantor later became Tether’s asset manager, and its position as a so-called primary dealer in the treasury market meant that it could liquidate assets with relative ease. The firm also reportedly won the business of some crypto-trading firms who are Tether customers.

El Salvador

Even before relocating and re-incorporating in El Salvador, Tether’s managers apparently exercised significant influence in Bukele’s crypto-happy regime.

Salvadoran media reports show that Max Keiser and Stacy Herbert, US crypto advocates who head El Salvador’s national bitcoin office, are also investors in Bitfinex, the cryptocurrency exchange that was founded by Tether’s Devasini and whose management overlaps with the stablecoin firm.

In 2023, Salvadoran newspaper El Faro called the office they run “Bitfinex’s puppet embedded in the Salvadoran state”.

That year, Tether announced a $250m investment in Bukele’s project that sought to harness geothermal energy to fuel bitcoin mining at a so-called “Volcano Energy” park.

The company also planned to collaborate in the issuance of bonds to finance the construction of a planned bitcoin city in the country, though that project never came to fruition.

More recently, Tether identities have been on a real estate spending spree in the country.

According to reports, Devasini bought a house in San Salvador for $2m.

He also reportedly bought a historic hotel building in downtown San Salvador in a joint venture with Keiser. This purchase of “a prime location in the historic center”, according to El Faro, came into force after the regime exempted investors in that part of town from income tax.

Tether’s CEO, Paolo Ardoino, bought two plots of land in the port city of La Libertad, in a deal that revealed he had been naturalized as a Salvadorian citizen.

Tether is also set to receive tax concessions for a planned 70-storey headquarters tower in San Salvador.

The Rumble deal

In the Rumble deal, concluded on 7 February, Tether Holdings handed $775m to Rumble, with $525m earmarked for a “self-tender offer” for a share buyback, and another $250m hitting Rumble’s balance sheet for “growth initiatives”, according to the announcement.

Weeks after the announcement, Rumble and El Salvador announced their partnership on cloud services infrastructure, despite the country announcing a separate deal with cloud titans Google in 2023.

Market analysts say this makes Tether the single largest shareholder in the company, with just more than 20% of all outstanding shares.

But the deal also put constraints on Tether’s influence over Rumble. According to Rumble’s 20 December press release and the SEC filing announcing the deal, “Rumble’s existing Board and governance structure, including Chris Pavlovski’s super-majority voting control, will remain unchanged”, and “Tether will own a minority position in our outstanding common stock but will not have the right to designate any members of the Board”.

This lack of say in Rumble’s operations is not offset by the likelihood of near-term profits.

Writing on the Tether-Rumble deal when it was announced in December, financial news site Sherwood reported that “by any conventional metric, Rumble is just a really, really bad business”, noting that “in Q3 2023, it lost $29m on $18m in revenue, and in Q3 2024 it lost $32m on $25m in revenue”.

Sherwood also noted that “the company’s cash and cash equivalents shrank from $218m at the beginning of the year to $131m at the end of September” and that “at its current pace the company would be running low on cash within the next 12 months”, since “despite its revenue growth, Rumble’s losses have grown even faster”.

Rumble’s Trump connection

Tether’s interest in buying into Rumble – even without any significant say over its operations – may be explained by its alignment with the Trump administration.

The company’s central offering is an “anti-woke” video platform that won favor among Maga influencers beginning in 2020, amid crackdowns on pandemic and election disinformation on leading platforms such as YouTube.

At that time, Rumble leaned into an anti-“cancel culture” pitch, offered signing deals to rightwing, conspiracy-minded and contrarian creators such as Andrew Tate, Tulsi Gabbard and Glenn Greenwald, and positioned itself as a pillar of a rightwing “parallel economy” of explicitly ideological, Maga-forward companies advocating for an ideologically inflected vision of “free speech”.

In its first round of venture capital funding in 2021, lead investors were rightwing billionaire Peter Thiel and JD Vance’s venture fund, Narya Capital. Vance and Thiel reportedly exited their investments after Rumble went public in September 2022.

In 2022, Trump’s Truth Social platform, operated by Trump Media and Technology Group, became the first outside publisher to adopt Rumble’s ad network, an alternative to dominant players such as Google’s AdSense. At that time, Rumble’s CEO said the ad network’s mission was to “fight back against cancel culture”.

At the beginning of 2023, the company inked a “seven-figure” deal with Donald Trump Jr to exclusively carry his biweekly livestream show, Triggered.

Rumble sued the government of Brazil, alongside Trump Media, over a Brazilian judge’s order that the platforms remove accounts of a supporter of Brazil’s former president, Jair Bolsonaro.

On 12 February, Pavlovski was given a “new media” seat at the White House’s daily press conference, where he told spokesperson Karoline Leavitt “Rumble was a victim of censorship at the hands of multiple foreign governments” and asked: “Can you describe what the administration will do to protect US interests and values worldwide?”

Lutnick’s end

Via Cantor, Lutnick was also deeply involved with Rumble.

Under Lutnick, Cantor “made a fortune, thanks to a favorable deal structure”, according to Forbes when it sponsored the special purpose acquisition company that took Rumble public in 2022.

Spacs allow private companies to go public by merging with a shell company set up to explore such merger opportunities. They have been popular in the last half-decade because they enable companies to avoid the investor and regulatory scrutiny that comes ahead of a more conventional initial public offering.

Spac sponsors, such as Cantor, are generally issued with stocks and warrants in the eventual public company with little downside risk. In the Rumble Spac, 12m shares, or 4.6% of the total, were issued to “Sponsor Related Parties” according to Securities and Exchange Commission filings.

Prospectuses filed by Rumble show that at the time the company went public, several people and entities related to Lutnick and his family had also been dealt in. Lutnick 2020 Descendants Trust UA had 375,000 shares; his wife, Allison Lutnick, had 50,000 shares; and his sister, Edith Lutnick, had 35,000 shares.

This may be the source of the holdings disclosed in Cantor’s most recent holdings report, filed on 14 February, which indicates that the company he led holds 9.3m Rumble shares, which at that time they valued at over $120m.

Lutnick personally owned between $1m and $5m worth of Rumble stock according to his Office of Government Ethics filings.

Finally, Cantor was the placement agent for Tether’s buy-in to Rumble. Normally such a role attracts fees, but Lutnick said at his confirmation hearing that on this occasion Cantor waived them.

Rumble

Rumble had several officers and shareholders besides Lutnick who have since gone on to serve in the Trump administration.

Tech-right ideologue and venture capitalist David Sacks resigned from Rumble’s board in December “to pursue a position in government”, according to a 13 December SEC filing. He now serves as the Trump administration’s “crypto czar”.

Sacks joined the board in 2023 after Rumble acquired Callin, the podcasting and livestreaming platform he founded, and Locals, a crowdfunding platform fronted by rightwing comedian Dave Rubin that Sacks had backed.

Any share sales he made in the February deal were not subject to insider trading disclosures. However, the most recent filing detailing Sacks interest in the company from last July shows him increasing his shareholding to just over 571,000 shares, a position being worth over $4.2m in the Tether deal.

Ethan Fallang, formerly a board member of Rumble and Narya Capital – the Vance-founded venture firm – resigned in January to work in government, according to SEC filings. The most recent documentation of his holdings while he was still on the board show him owning some 27,000 shares.

Although he is not subject to insider trading disclosures, filings show that Trump’s deputy FBI director, Dan Bongino, has maintained his 5.72% share in Rumble since it went public. No OGE agreements or disclosures for Bongino have been made public to date.

OGE disclosures do indicate that on the way into their jobs, Bongino’s new boss, Kash Patel, held between $1,001 and $15,000 worth of stock; transportation secretary Sean Duffy held between $1,000 and $15,000; and the director of national intelligence, Gabbard, held between $100,001 and $250,000 of the stock.

Patel, Gabbard and Lutnick all undertook to divest themselves of holdings including their interest in Rumble within 90 days of taking office, according to their OGE agreements.