18h30 ▪

6

min read ▪ by

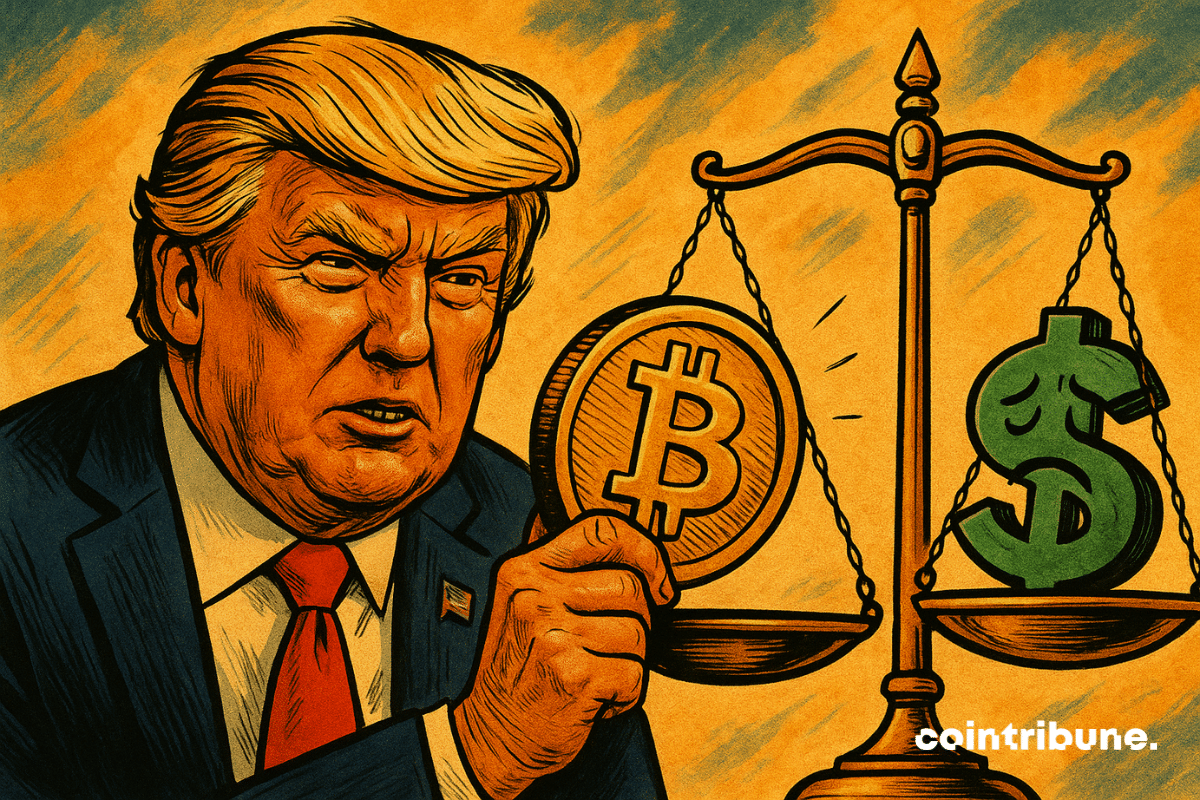

It’s hard to believe, but Donald Trump views bitcoin becoming the ultimate international reserve currency favorably.

In Brief

- Trump supports a weaker dollar to boost American production and reduce the trade deficit.

- The White House is planning a strategic bitcoin reserve, with initiatives to accumulate as many bitcoins as possible before it becomes a major international currency.

The Inevitable Sacrifice of the Dollar

The dollar is down more than 11% since the beginning of the year (DXY). Morgan Stanley expects it to decline another 9% over the next 12 months. Great news for Donald Trump whose priority is to stimulate American production.

The American president believes a strong dollar harms the manufacturing industry and the competitiveness of the United States. He stated in 2017: “our currency is too strong and we are dying a slow death because of it.”

What is his goal? To reduce the country’s unsustainable trade deficit. This policy of competitive devaluation, called “the Mar-a-Lago deal”, is behind the tariff strategy.

Message received in Asia where the dollar is actively being discarded. The greenback has lost 10% against the Taiwanese currency since early April. And more than 5% against the Korean, Thai, Malaysian, and Singaporean currencies.

Some speak of an “reversed Asian crisis” referring to the collapse of Asian currencies in the 1990s. The countries of the region then had the habit of accumulating large dollar reserves as a precaution. But perhaps not for much longer.

According to Robin Xing, chief economist at Morgan Stanley, Asian investors are moving towards a diversification strategy and abandoning the outdated idea of the absolute supremacy of the dollar.

The same tone on CNBC where billionaire Philippe Laffont said that “the dedollarization of the world [and] the end of American exceptionalism” will certainly benefit bitcoin.

Nothing new under the sun. However, what is more surprising is that the White House doesn’t worry in the least that bitcoin might overshadow the dollar.

The End of the Exorbitant Privilege

It is difficult to reconcile the fact that Donald wants a weak dollar while wishing it to remain the ultimate international reserve currency.

He still declared on June 15, 2025, that “The dollar must remain strong; it is the backbone of our economy and the trust the world places in us. We cannot afford to let it weaken, especially with all the global challenges we face.”

The former President of Brazil did not hesitate to point out this contradiction. Dilma Rousseff reminded that the United States trade deficit is primarily due to the “exorbitant privilege” of the dollar, which drives Washington to go into debt and import more than they export, without immediate consequences:

In other words, Donald Trump cannot have his cake and eat it too. Becoming a manufacturing power again, or holding the global reserve currency, he will have to choose. He knows it, at least that is what his latest statements regarding bitcoin suggest:

I have noticed that more and more payments are being made in Bitcoin… Some people say it takes a lot of pressure off the dollar, and that’s a great thing for our country.

Donald Trump

The exorbitant privilege is a double-edged sword. It requires staying at the cutting edge of innovation while preventing the emergence of rivals. Bad luck, China has come to spoil the party.

It is enough to be convinced of this by observing the drift of the debt/GDP ratio and the twin deficits (trade and budget) of the United States. It is the boomerang effect resulting from decades of monetary hegemony.

There remains the poker move called bitcoin.

The Dollar is Dead, Long Live Bitcoin

The strategic reserve of bitcoins is not a pipe dream. It is coming. This is what White House advisor Bo Hines declared this Friday:

We are building the infrastructure to establish the strategic reserve and increase our bitcoin reserves. We have repeated many times that bitcoin is digital gold and we believe it is in the best interest of the United States to accumulate as much as possible.

Bo Hines, White House Advisor in charge of the Bitcoin file

The only constraint will be not to encroach on the nation’s budget. However, Bo Hines’ intense looks towards Senator Cynthia Lummis suggest that the plan is to trade gold for bitcoin:

Donald Trump is betting that acquiring millions of bitcoins will compensate for the abandonment of the exorbitant privilege. The coming months promise to be truly fascinating.

While waiting for the American Congress to give the green light, the Federal Housing Finance Agency (FHFA) has just endorsed bitcoin as collateral to obtain a mortgage loan.

This decision echoes recent statements by Federal Reserve Chairman Jerome Powell, who said banks are free to integrate bitcoin into their activities. That said, note that all major American banks already allow their clients to buy bitcoins through their apps.

Citibank has said that bitcoin could “become the currency of choice for international trade.” Bank of America, for its part, compares it to innovations such as the printing press, the light bulb, or artificial intelligence:

It is certain that 2025 will be a pivotal year. The whole world will follow the United States, and it would be devilish if bitcoin does not approach $200,000 in the very near future.

Don’t miss our article: BTC/USD: The Bull Run Resumes.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.