Cathie Wood, CEO of ARK Invest, has expressed confidence that a new directive from the U.S. Federal Housing Finance Agency (FHFA) could have a major impact on Bitcoin.

The move, which aims to incorporate cryptocurrency holdings like Bitcoin into the mortgage qualification process, may help crypto holders access home loans without needing to convert their digital assets into traditional currency. This proposed rule has drawn attention from various financial leaders, including Wood herself, who predicts it could provide a substantial boost to Bitcoin’s role in the financial ecosystem.

FHFA’s Proposal to Include Bitcoin in Mortgage

The FHFA recently stated it will consider a possibility of using cryptocurrency holdings as part of meeting mortgaging requirements. This action is in line with an initiative to see digital assets such as Bitcoin in the wider financial environment. The proposed rule will recognize the legitimacy of cryptocurrencies as wealth especially by people who have accumulated substantial wealth in digital currencies.

Bill Pulte stated that the goal is to study how cryptocurrencies could be used to assess a borrower’s financial standing. “We will study the usage of cryptocurrency holdings as it relates to qualifying for mortgages,” Pulte said. This development indicates a shift in traditional banking practices, which have long excluded digital currencies from financial assessments, particularly in home financing.

Under the new directive, people who hold Bitcoin or other cryptocurrencies could potentially use them as assets in the mortgage qualification process. This would allow individuals to secure loans without the need to liquidate their crypto holdings.

Role of Bitcoin in the Mortgage System

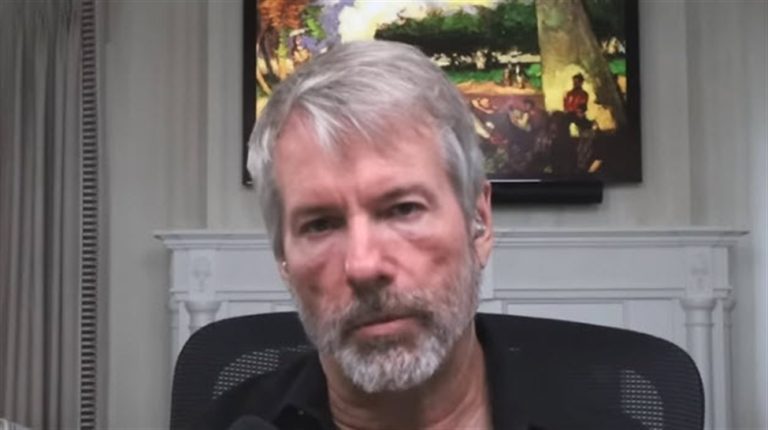

Like Cathie Wood, Michael Saylor has been vocal about the potential benefits of using Bitcoin as collateral for home loans. He has argued that Bitcoin should be treated as legitimate capital, rather than a speculative asset. Saylor’s stance aligns with the broader push to integrate cryptocurrencies into traditional financial systems. According to Saylor, allowing Bitcoin in mortgages would help bridge the gap between digital wealth and the traditional banking system.

“Home ownership shouldn’t be out of reach for people with Bitcoin holdings,” Saylor stated. This claim appeals to early adopters of Bitcoin and other digital nomads who earned lots of money investing in crypto but ran into issues when they sought a loan because they had no formal proof of their income.

The new rule would be a radical change in the customary mortgage qualifying practices. Generally, lending institutions judge the capacity of borrowers to pay back the loans on the basis of the income, credit history and occupation. Such criteria, however, are not necessarily consistent with the financial portraits of crypto holders. Crypto holders with significant portfolios might not necessarily have income streams, so obtaining a mortgage can be challenging. The new FHFA rule aims to address this by considering digital assets as a form of financial backing.

Potential Consequences for the Crypto and Housing Markets

The possible consideration of cryptocurrency in housing evaluations can redefine the housing market and the cryptocurrency market. On the part of Bitcoin holders, the proposal may offer an easier option to own a home.

The concept of mortgage and securitization on Bitcoin might establish a different level of liquidity wherein investors of crypto could use them as leverage without the need to sell by cashing them in traditional money.

In addition to this, the decision may affect the overall cryptocurrency market, attracting additional institutional participation. By becoming increasing merged with traditional financial systems, crypto might become more widely accepted as a legitimate asset class. According to financial experts, this can increase mainstream use of Bitcoin and other cryptocurrencies, not just as a speculative equity but also as a useful means to wealth-creation and asset-backing.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

✓ Share: