Bitcoin’s shrinking supply: What’s going on?

With less BTC in circulation, experts are bracing for a potential supply shock.

Bitcoin’s hard cap of 21 million coins has always been central to its appeal. However, by 2025, this built-in scarcity is no longer just a theoretical feature; it’s becoming a market reality. 93% of all Bitcoin has already been mined, and since the network’s fourth halving in April, which cut miner rewards in half, fewer new coins are entering circulation each day.

At the same time, long-term holders are sitting tight. A growing share of Bitcoin is now locked in cold storage, tied up in institutional holdings or presumed lost. About 70% of the Bitcoin supply hasn’t moved in at least a year, a sign that liquidity is drying up.

With the addition of increasing demand from spot exchange-traded funds (ETFs), public companies and even sovereign wealth funds, the result is a tightening market that has analysts warning of a potential supply shock, a moment when available Bitcoin (BTC) on exchanges becomes too scarce to meet demand, potentially triggering sharp price moves.

Michael Saylor’s Bitcoin Strategy: Relentless accumulation

Saylor’s Strategy now holds about 3% of all Bitcoin that will ever exist, and he’s not slowing down.

Michael Saylor, executive chairman of Strategy, has made Bitcoin accumulation his life’s mission. Since 2020, he’s turned the software company into a full-blown BTC holding vehicle, borrowing money, issuing stock and spending company cash to buy more Bitcoin.

As of mid-2025, Strategy holds more than 2.75% of the total Bitcoin supply (approximately 582,000 BTC) and continues to buy more every month. This aggressive approach fuels concerns that a BTC supply crisis may be on the horizon. Fewer coins available on exchanges means less liquidity, especially for new entrants or retail traders looking to buy in.

Did you know? Strategy now sits atop the public leaderboard for BTC reserves, holding more coins than the US and Chinese governments combined. Its stash is almost twelvefold larger than that of the next-closest holder, Marathon Digital Holdings.

Bitcoin supply meets institutional demand

Institutions are no longer just watching crypto — they’re buying in bulk.

Bitcoin’s shift from retail speculation to institutional-grade asset is now unmistakable. Spot Bitcoin ETFs in the US and elsewhere have opened new gateways for pension funds, banks and investment firms.

BlackRock’s iShares Bitcoin Trust (IBIT) averaged $430 million net inflow per day over late May 2025, culminating in $6.35 billion of inflows for the month, its largest ever. When institutions buy through spot ETFs, the underlying Bitcoin is moved into custodial cold storage. These flows pull coins off exchanges, tightening liquid supply in the market.

This surge in institutional demand adds another layer to the Bitcoin supply-and-demand imbalance. Even conservative banks now consider BTC a long-term hedge.

On May 27, Trump Media and Technology Group, the parent company of US President Donald Trump’s Truth Social, confirmed a $2.5-billion fundraising round to acquire Bitcoin, reversing earlier denials. Around the same time, GameStop disclosed a $500-million Bitcoin investment.

Meanwhile, Tether, SoftBank and Strike CEO Jack Mallers announced the launch of Twenty One, a Bitcoin-native public company set to debut with over 42,000 BTC on its balance sheet, making it the third-largest corporate holder globally.

Did you know? In 1992, MicroStrategy (now Strategy), co-founded by Michael Saylor, landed a major $10-million deal with McDonald’s to create software designed to analyze the effectiveness of its promotional campaigns.

Bitcoin halving and whale accumulation: Is the market too top-heavy?

The 2024 halving reduced miner rewards from 6.25 to 3.125 BTC, limiting new supply entering the market. Still, a few players now control a large portion of all Bitcoin, sparking both bullish and critical takes.

Bitcoin’s built-in halving cycle occurs roughly every four years and reduces the number of new coins that miners receive for validating blocks. After the April 2024 halving, that number dropped to just 3.125 BTC per block, cutting Bitcoin’s inflation rate to less than 1% annually.

While this is nothing new for seasoned crypto watchers, the latest halving landed at a time of surging demand and heightened accumulation, creating the perfect storm. As of June 2025, daily issuance is 450 BTC, while Strategy alone buys more than that per week.

Strategy isn’t the only whale. Public wallets tied to Grayscale, Binance and several ETF custodians now rank among the largest holders of BTC. In total, the top 100 addresses still control about 15% of the total supply.

Critics warn that this creates Bitcoin ownership concentration, where power is consolidated in a small group of hands, challenging the original ethos of decentralization. The wealthiest entities now control a significant slice of Bitcoin: Addresses holding 10,000 BTC account for 14% of all coins, raising questions about concentration vs. confidence. Others argue it shows confidence: These whales aren’t flipping BTC for quick profit; they’re holding for the long game.

Did you know? By mid-2025, about 59% of institutional investors had allocated at least 10% of their portfolios to Bitcoin and other digital assets. This marks a dramatic leap from previous years and signals Bitcoin’s transition from a speculative asset to a core portfolio holding.

Liquidity crunch: Will Bitcoin run out?

No, Bitcoin won’t “run out,” but usable, tradable supply may dry up.

One common misunderstanding is that Bitcoin will disappear from circulation. That’s not quite true. However, a Bitcoin liquidity crisis can occur when a significant portion of the supply is held offline, in cold wallets or ETFs, rendering trading inefficient.

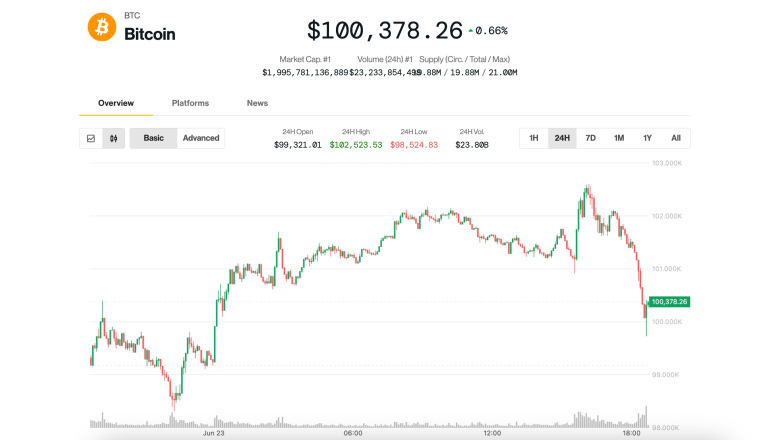

Already, onchain data shows that exchange balances are at their lowest levels in years. This can lead to more volatile price swings, both up and down, as small changes in demand hit a thin supply.

As of early June 2025, the share of Bitcoin on exchanges has dipped below 11% of the total supply, the lowest level since early 2018, creating a “dry market” prone to larger price swings.

Will there be a Bitcoin supply shock in 2025?

It’s already unfolding, just not all at once.

You may not see a single explosive moment when Bitcoin “runs out.” But all signs point to a slow-burning BTC supply squeeze. From miners earning less to institutions buying more to whales refusing to sell, the pressure is building.

Whether it triggers a price spike depends on one thing: new demand. If retail, corporate and national buyers continue piling in, Bitcoin’s limited supply could create a feedback loop of rising prices and even greater demand.

“Over the long term, Bitcoin on the balance sheet has proven to be extraordinarily popular,” Saylor said.

Did you know? Since Michael Saylor’s company (Strategy) began buying Bitcoin in August 2020, BTC’s price has soared by 700%. Strategy’s bold accumulation not only boosted its own stock price by 2,500% but also inspired a wave of institutional and corporate adoption.

Bitcoin’s scarcity tested in real time

Scarcity was always part of Bitcoin’s core narrative, but now it’s being stress-tested in real time.

The combination of shrinking supply, institutional hoarding and diminishing miner rewards is pushing Bitcoin into a new phase. Whether you see it as a bullish supply shock or a concerning centralization trend, the dynamics are clear: There’s less Bitcoin to go around.

And this isn’t just about math; it’s about perception. If institutional inflows continue and everyday users struggle to buy even small amounts without premiums, a bullish supply shock may emerge.

And yet, the macro backdrop matters:

- Interest rates remain high globally.

- Governments are cautious with Bitcoin due to regulatory uncertainty and environmental, social and governance (ESG) concerns.

- Gold is still favored by central banks as a reserve asset; over 1,000 tons was added to global reserves in 2024 alone.

So, will Bitcoin dethrone gold as the premier store of value? Not yet. But 2025 marks the first time in history where Bitcoin’s scarcity profile is tighter, its supply dynamics more aggressive and its adoption narrative broader than gold’s.

Investors, regulators and average users alike should watch the space closely. If Saylor and other whales keep accumulating and demand keeps rising, the real question might not be if there’s a supply shock, but how high Bitcoin might go when it hits.