15h05 ▪

4

min read ▪ by

Despite Bitcoin falling below $100,000 following U.S. airstrikes in Iran, the options market remains remarkably optimistic. Investors are heavily positioning themselves for a recovery, despite increased volatility. Is it a risky bet or a clear-sighted anticipation of a rebound?

In Brief

- Bitcoin fell below $100,000 after the announcement of a U.S. airstrike in Iran.

- Open interest on Bitcoin options reached a record $51 billion.

- The majority of positions remain bullish despite a tense geopolitical context.

- The market anticipates short-term turbulence but remains confident for the long term.

Interest in Bitcoin options explodes despite tense context

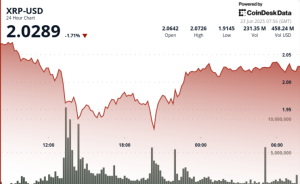

The escalation of the conflict in the Middle East, notably after Donald Trump announced U.S. strikes on Iranian nuclear sites, shook the crypto market on Sunday.

Bitcoin briefly plunged to $98,200, temporarily wiping out $40 billion in market capitalization within a few hours. The crypto queen has since rebounded and is currently trading around $101,000.

However, Coinglass data reveals a remarkable resilience in institutional investor sentiment. Open interest on Bitcoin options surged to $51 billion, a level demonstrating massive market participant engagement.

This colossal sum far exceeds the $17 billion recorded for Ethereum, confirming Bitcoin’s status as a “digital store of value” during times of uncertainty.

On Deribit, the leading crypto options trading platform, the position distribution reveals cautious but persistent optimism. Calls represent 59.73% of open contracts on Bitcoin, compared to only 40.27% for puts.

This configuration suggests professional traders still bet on a recovery despite geopolitical shocks.

The analysis of 24-hour trading volumes offers a more nuanced perspective. With 24,780 BTC traded via put options versus 24,168 BTC for call options, there is a relative balance reflecting some short-term caution.

A smart hedging strategy in the face of uncertainty

The most popular positions reveal the sophistication of strategies deployed by institutional traders. The most traded contract bets on Bitcoin dropping to $95,000 or less by June 27, with over 2,000 BTC committed.

Meanwhile, a competing bet anticipates a rise to $105,000 by July 11.

This duality perfectly illustrates the philosophy of savvy investors: protecting against short-term shocks while maintaining a bullish medium-term outlook.

Nearby expirations serve as insurance policies, while more distant positions reflect confidence in Bitcoin fundamentals.

For Ethereum, the situation presents interesting similarities. With 67.39% calls versus 32.61% puts, the optimism appears even stronger. Traders nonetheless speculate on corrections towards $2,000-$2,200 by the end of June, suggesting expectations of similar volatility.

This sophisticated approach shows the growing maturity of the crypto market. Institutional investors no longer blindly “HODL”, but deploy complex risk management strategies that allow them to navigate uncertainty while preserving exposure to potential gains.

All in all, the drop of Bitcoin below $100,000 has not shaken the confidence of seasoned traders. Behind the short-term turbulence, the options market continues to bet on a bullish future. A risky strategy? Perhaps. But in an uncertain world, Bitcoin remains, for many, a value of anticipation.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j’aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l’outil qui peut rendre cela possible.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.