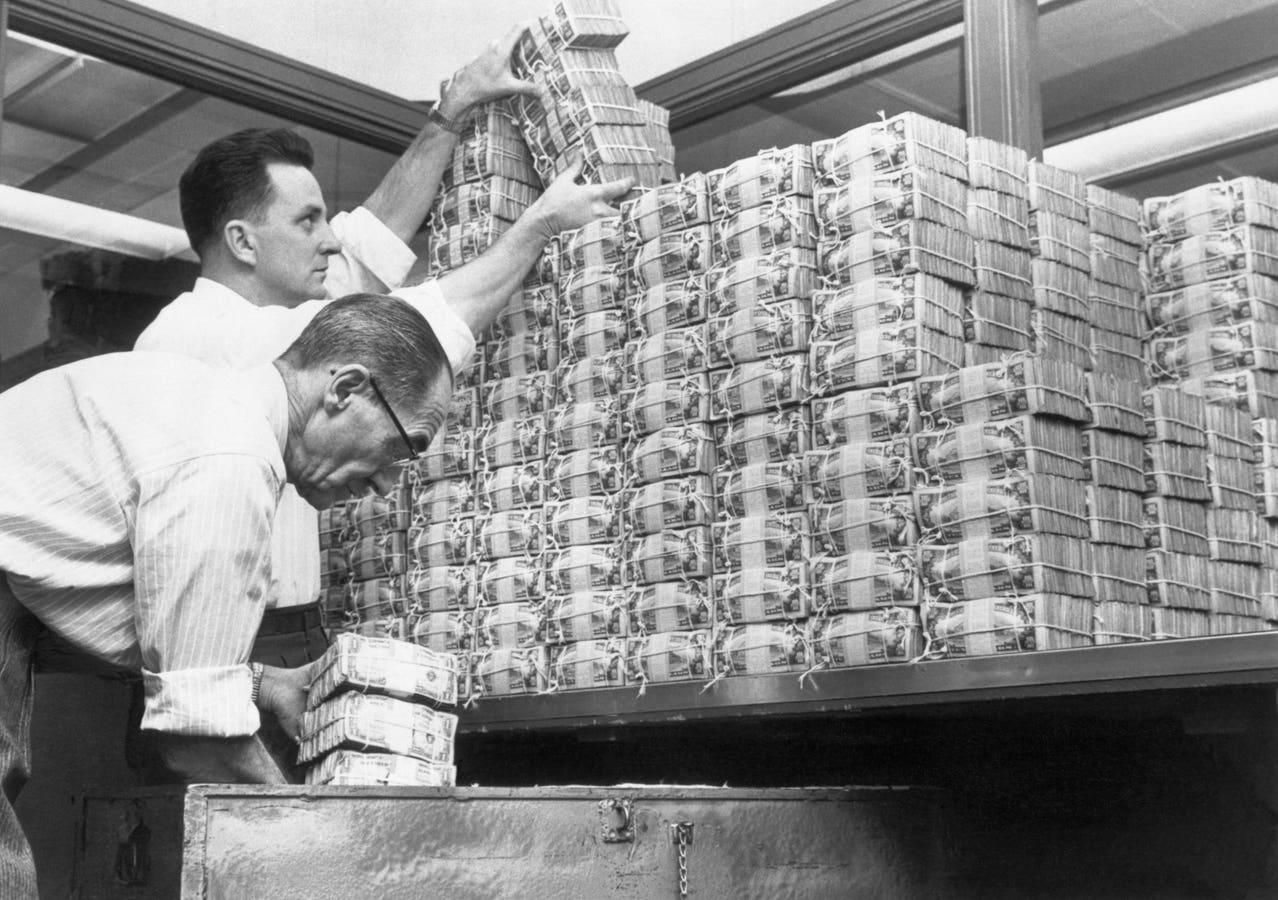

(Original Caption) 12/12/1956- This miniature skyscraper is made of bundles of new United States … More

Stripe’s latest acquisition isn’t just another crypto bet. It’s the clearest sign yet that fintech giants are preparing to bypass the banking system entirely. While much of crypto obsesses over price charts and memecoins, Stripe is quietly assembling something far more disruptive: a crypto native financial operating system. With the acquisitions of Bridge and Privy, Stripe isn’t just enabling stablecoin payments. It is removing banks from the equation entirely. If you understand what these moves unlock, it becomes clear: Stripe isn’t chasing the future of payments. It is building it.

Most people see Privy as a wallet company. Stripe saw it as something else entirely: a regulatory unlock. By combining Privy’s embedded, non-custodial wallet infrastructure with Bridge’s stablecoin payment rails, Stripe is quietly bypassing the constraints that have kept fintech tethered to the banking system. No sponsor banks. No custodial risk. No need to hold customer funds. Just programmable, borderless finance delivered through APIs. This isn’t a crypto feature. It’s a foundation for a new financial stack.

With these pieces in place, Stripe can turn any app into a fintech product overnight. Marketplaces can spin up user wallets without touching custody. Gig platforms can hold balances for workers across borders. Emerging market startups can offer dollar accounts without needing a U.S. banking partner. All of it happens through infrastructure Stripe now controls, using crypto rails that settle globally, instantly, and without friction. While others debate the future of stablecoins, Stripe is already operationalizing it.

The implications go far beyond developer tooling. Stripe is positioning itself as the backbone of a new global financial system, one that doesn’t rely on banks, card networks, or compliance middlemen. In doing so, it’s not just enabling crypto adoption, it’s removing traditional finance from the loop entirely. If the banks understood what Stripe was building, they wouldn’t see it as a crypto experiment. They’d see it as an existential threat.

What makes Stripe dangerous is not just its infrastructure. It’s the distribution. Stripe already powers payments for millions of businesses around the world and processed over $1.4 trillion in total payment volume in 2024, a 38% increase from the year prior, according to the company. Now it’s layering in stablecoin rails and wallet infrastructure directly into that stack. While most crypto startups are still trying to find product-market fit, Stripe is embedding crypto into workflows that already move billions of dollars. It isn’t starting from zero. It’s turning the internet’s default payment layer into a gateway for onchain finance.

There’s also a quiet regulatory brilliance to all of this. By using non-custodial wallets, Stripe avoids the licensing burdens that have tripped up fintechs trying to hold user funds. With Bridge, it gains compliant on and off ramps in over 100 countries. The result is a modular financial stack that sidesteps the chokepoints of traditional finance without breaking the rules. It’s not about avoiding regulation. It’s about designing around it.

This unlocks use cases that would have been operationally or legally impossible just a few years ago. Platforms can offer stablecoin accounts without becoming banks. Merchants in emerging markets can settle in dollars without touching a wire transfer. Payroll companies can pay freelancers instantly, globally, and without FX risk. Stablecoins aren’t just speculative tools, they’re being used for real-world needs. According to Chainalysis, year-over-year growth in stablecoin transfers was strongest among retail and professional-sized transactions, particularly in lower-income regions like Sub-Saharan Africa and Latin America. These aren’t theoretical use cases. They’re already happening. What used to take months of compliance work and banking partnerships now takes a few lines of code.

What’s missing is the front end. Stripe has everything it needs to power the onchain economy behind the scenes, but at some point, owning distribution may become strategically necessary. A consumer wallet, a neobank acquisition, or even a simple interface to hold and spend stablecoins could close the loop. Stripe wouldn’t need to become a retail brand, just the infrastructure behind one. But if it does decide to go direct, it won’t be starting from scratch. It’ll be plugging into a system it already owns.

That’s where Stripe’s real edge comes into focus: data. Today, Stripe sees a massive share of global card activity, giving it a powerful fraud and risk engine built on years of transaction history. Extend that to wallets, and the advantage compounds. As millions of embedded wallets come online through its stack, Stripe can link identity, behavior, and financial history across users and platforms. That turns compliance into a product, not a bottleneck, and it makes Stripe indispensable to anyone building onchain.

Stripe’s strategy isn’t happening in a vacuum. It reflects a broader shift among fintechs and big tech companies looking to untether themselves from traditional banking infrastructure. PayPal’s launch of PYUSD in 2023 signaled similar intent, to leverage stablecoins for global payments, but Stripe’s infrastructure-led approach goes deeper. As regulatory pressure mounts and banking relationships grow riskier, especially after collapses like Synapse, the appeal of crypto rails becomes obvious. Stablecoins, non-custodial wallets, and programmable money offer a faster, cheaper, and more flexible path to launching financial products. Stripe just moved first. Others will follow.

This isn’t another crypto side feature bolted onto an existing product. It’s a reimagining of the financial stack, starting with infrastructure, not hype. Stripe isn’t chasing the next bull market narrative. It’s focused on utility, making stablecoins usable, wallets invisible, and compliance programmable. While most companies treat crypto as a speculative asset class, Stripe is treating it like plumbing. And in infrastructure, the winners are the ones you barely notice, until everything runs through them.

Stripe isn’t building for headlines. It’s building for inevitability. In a world where value moves as freely as data, the financial layer of the internet won’t rely on banks or legacy payment networks. With Bridge and Privy in place, Stripe may be positioned to quietly power the infrastructure layer of the next financial era.