21h05 ▪

5

min read ▪ by

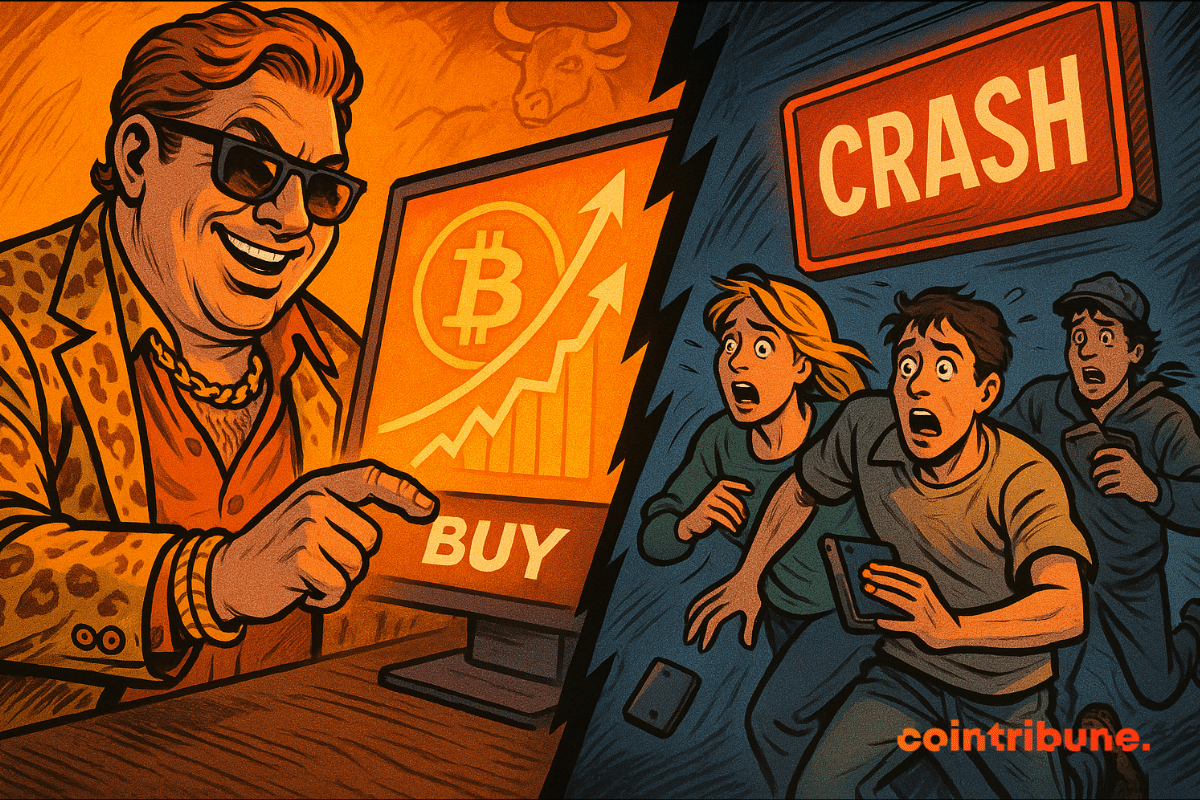

The quietness in the Bitcoin market is making some traders uneasy, with price consolidation shaking confidence and fuelling fear among retail investors—many of whom are pulling back, expecting a downturn—but some experts view this calm as a bullish signal.

In Brief

- Retail sentiment splits, with slightly more traders expecting prices to drop.

- Whales now dominate volume, with large transfers making up 89% of activity.

- Wallets holding 10+ BTC rise as smaller wallets drop sharply in 10 days.

- Fear and Greed Index drops from 70 to 54, signalling market uncertainty.

Bearish Bias Grows Amid Mixed Market Signals

Blockchain analytics firm Santiment said on Wednesday that opinions are currently split across social media. Half of the traders think Bitcoin will rise, while the other half believe it will fall.

Still, slightly more people are feeling negative than positive. According to Santiment, there are now 1.03 bearish comments for every bullish one. This is the lowest the mood has been since April 6, when traders were worried about global tariffs.

Even though retail sentiment is falling, Santiment noted that markets often move in the opposite direction of the crowd.

Markets historically move the opposite direction of retail’s expectations. A prime example was the optimal buy time during the early April fear from other traders.

Santiment

Meanwhile, the Bitcoin Fear and Greed Index has dropped to 54, signalling a neutral market mood. Just a month ago, it stood at 70, reflecting strong optimism. The decline shows a shift in sentiment, with confidence fading and no clear direction in sight.

Bitcoin Remains Strong Despite Quiet Network

Despite the dip in sentiment, Bitcoin’s price has remained firm above the key $100,000 mark, though data from Glassnode shows that on-chain activity isn’t keeping pace—signalling a potential shift in how, and by whom, Bitcoin is being used.

What the Bitcoin Market Is Telling Us:

- Bitcoin stays strong above $100K, but overall network activity remains subdued.

- Monetary transactions have held steady, showing stable value transfers over the past year.

- Non-monetary actions surged in late 2024 but dropped sharply in early 2025.

- Average daily settlement remains high at $7.5B, despite a drop in total transactions.

- Large transfers now make up 89% of volume, showing whales dominate on-chain activity.

Smaller Investors Retreat as Whales Accumulate

While the network becomes quieter, the split in behavior between retail and institutional players is becoming more obvious.

Santiment reported that over the past 10 days, the number of wallets holding 10 or more Bitcoin rose by 231—a 0.15% increase.

In contrast, wallets with balances between 0.001 and 10 Bitcoin fell by 37,465, reflecting the same percentage change in the opposite direction.

This pattern suggests that while small investors are backing out, big holders are buying in. Santiment noted that this type of behavior has often led to a market recovery.

When large wallets accumulate as retail loses confidence, this is historically the right combination for bullish momentum to inevitably return to crypto markets.

Brian Quinlivan, Santiment marketing director

Ethereum is showing a similar trend. According to Lookonchain, a large investor, identified as wallet 0x9992, borrowed $10 million in USDT from lending platform Aave.

The funds were used to buy 3,983 ETH at a price of $2,510.64 each. This is another sign that major players are still interested in crypto.

Santiment added that there are now 6,392 wallets holding between 1,000 and 100,000 ETH. In the last month alone, these wallets have added a net total of 1.49 million ETH — a sign of confidence in Ethereum’s growing network and whale accumulation trends.

That’s a 3.72% increase in their holdings. These large Ethereum wallets now control 26.98% of the total supply.

This shift in behavior shows a growing gap between everyday traders and large investors. While smaller holders are selling and taking profits, institutional players are treating the current market as a buying opportunity.

They seem to be stepping in while prices are stable and sentiment remains uncertain. If past patterns hold true, this quiet period—with whales accumulating and retail traders stepping away—could be setting the stage for the next move up.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.