Bitcoin and crypto prices have soared this year, fuelled by a combination of U.S. president Donald Trump’s support and Wall Street adoption (with Tesla billionaire Elon Musk making a dramatic return to the front lines of crypto this week).

The bitcoin price, after rebounding sharply from its April lows, has held above $100,000 per bitcoin since early May even after BlackRock issued a serious bitcoin warning.

Now, as fears swirl of a “cataclysmic” U.S. dollar collapse, Jim Esposito, the president of market maker Citadel Securities, has warned the spiraling $37 trillion U.S. debt pile is a “ticking time bomb”—adding to similar warnings that some think could be about to send the bitcoin price sharply higher.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

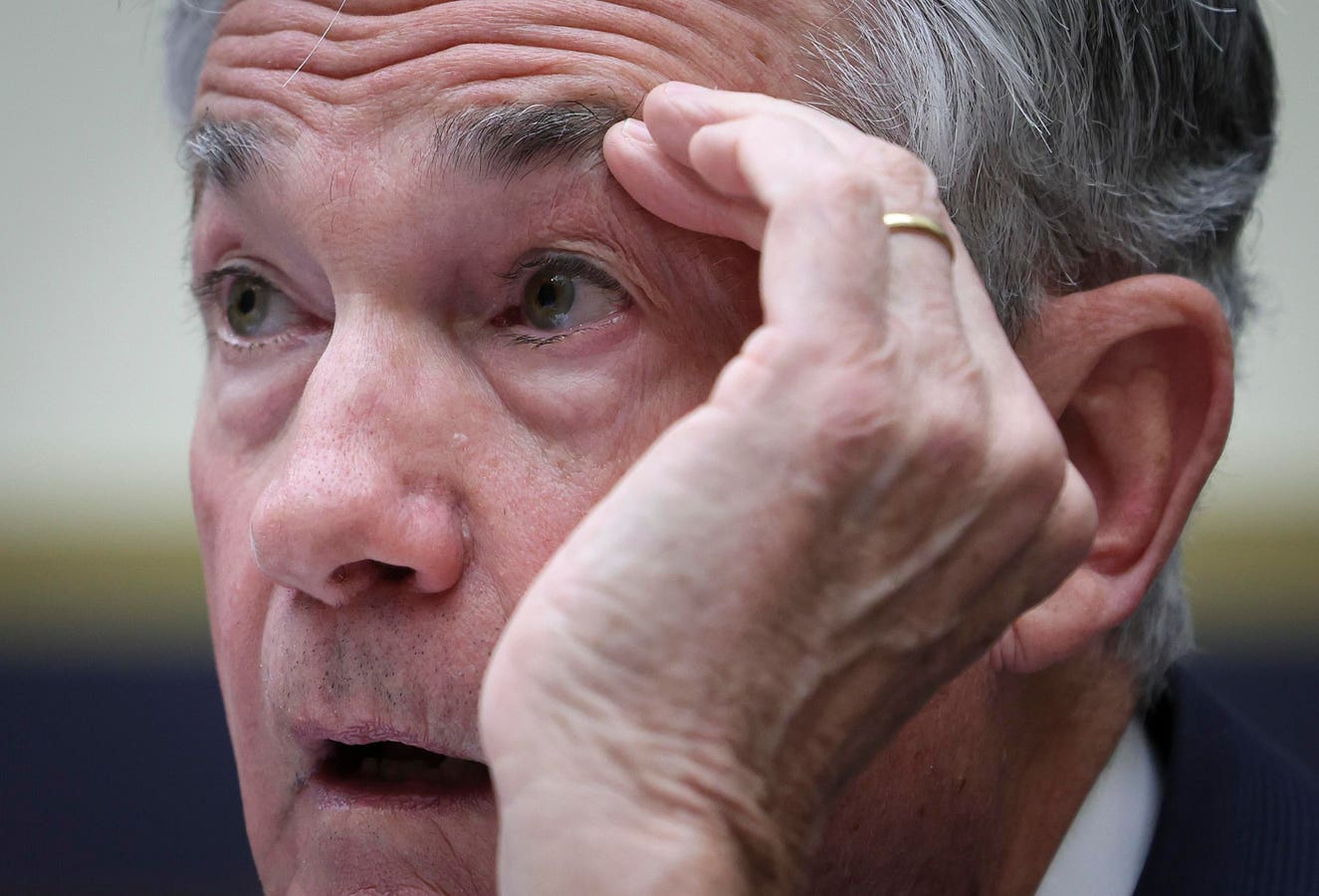

Federal Reserve chair Jerome Powell is grappling with a $37 trillion debt “ticking time bomb” as … More

“The stock of debt and the budget deficit is a ticking time bomb,” Esposito said at the Piper Sandler Global Exchange & Trading Conference in comments reported by Reuters.

“No one is smart enough to predict when exactly it will rear its ugly head. We’ve been talking about this for more than 20 years, so in some ways the market’s gone into complacency, but over a multi-year period we can work this out.”

Esposito added that Citadel Securities, a Wall Street market-making giant that was founded by hedge fund billionaire Ken Griffin, plans to ramp up its bitcoin and crypto trading this year in anticipation of a new crypto regulatory framework.

“Crypto is definitely a space we’re going to get bigger in, and we’re excited about the prospects,” Esposito added.

The worsening U.S. debt crisis, which has dramatically blown up the relationship between Elon Musk and president Trump this week, was exacerbated by massive government spending through Covid lockdowns.

The rise in U.S. debt comes as the Federal Reserve, led by chair Jerome Powell, holds the line on interest rates despite pressure from Trump and the bond market suffers highly volatile swings that are a sign of waning faith in the U.S. from investors.

Economic and monetary uncertainty has pushed some traders and companies toward bitcoin, leading to a flood of bullish bitcoin price predictions.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has set a new all-time high in recent weeks, soaring as fears swirl around the … More

“The dominant story for bitcoin has changed again,” Standard Chartered analyst Geoffrey Kendrick wrote in an emailed note. “It was correlation to risk assets … It then became a way to position for strategic asset reallocation out of U.S. assets.”

Kendrick has predicted the bitcoin price will soar to $500,000 per bitcoin by the end of Trump’s presidency in early 2029 as a result of his U.S. bitcoin strategic reserve and the ending of stifling regulations that will see more companies by bitcoin.

“Institutions are reinforcing their exposure to bitcoin, building out their bitcoin treasuries,” Seamus Rocca, the chief executive of bitcoin and crypto custody company Xapo Bank, said in emailed comments.

“Whether you’re looking at institutional flows or retail behavior, the message is the same: conviction in bitcoin’s long-term value is holding firm–and growing.”