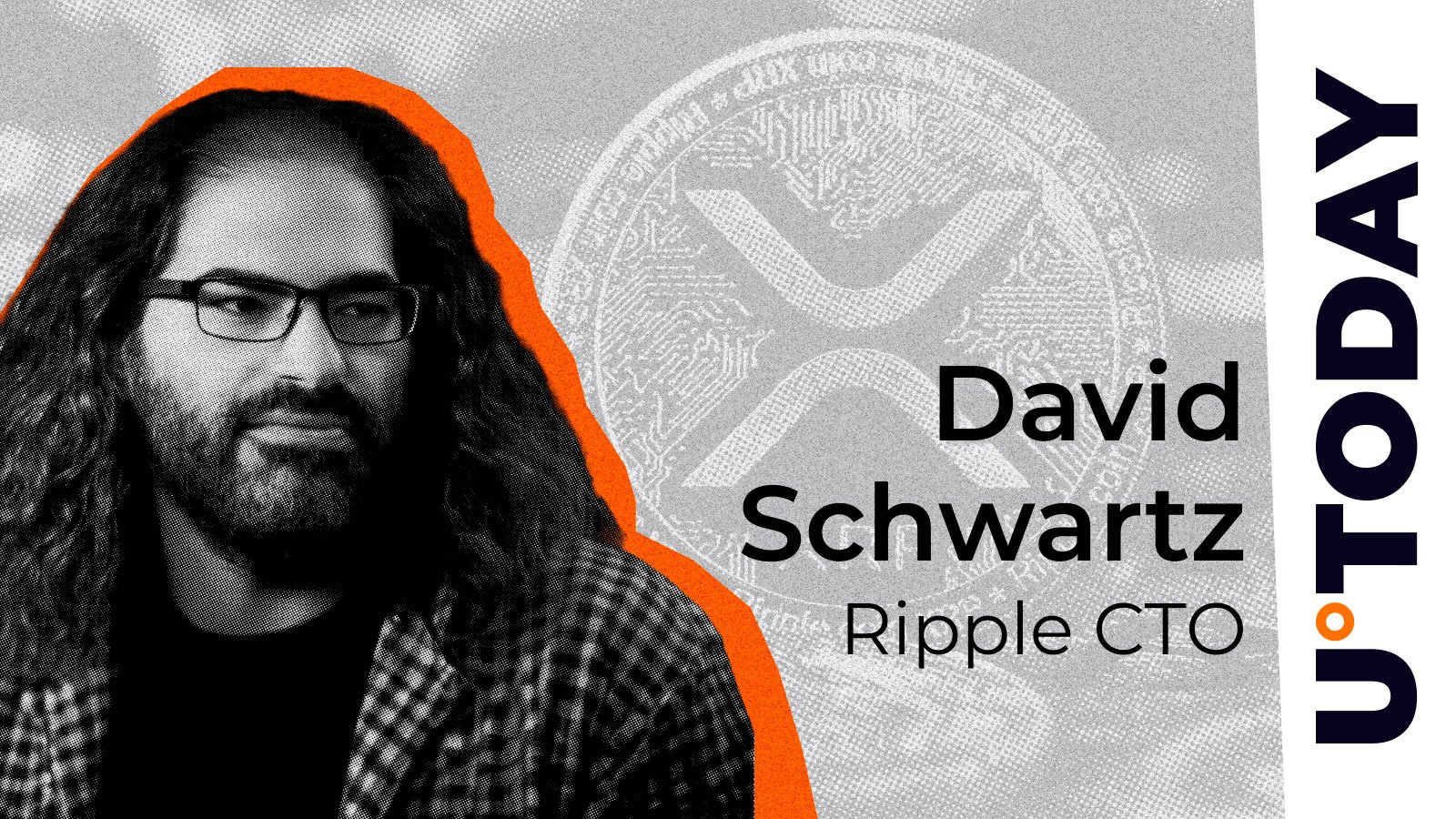

Ripple Chief Technology Officer David Schwartz has offered one of the clearest public signals yet about where he sees XRP and the broader XRPL ecosystem heading – and it is not just about crypto anymore.

In a series of direct posts, Schwartz said the technologies Ripple has built could reasonably be considered a financial system, not just a payments tool.

His view is that the XRPL, paired with components like XRP and stablecoins like RLUSD, could start covering a much wider slice of traditional finance – from loans to investments to everyday payments. It is a step toward making blockchain infrastructure usable in the same way banks and fintechs operate today, only faster and more open, according to Schwartz.

XRP Ledger (XRPL) is more than just XRP. It is a base layer that will soon have tokenized real-world assets, stablecoins and lending markets, as the Ripple CTO says – a DEX cannot work with just one asset, and a more diversified and utility-driven network is needed.

XRP is still in a league of its own, though, as the only asset without a counterparty and the only one every account can receive by default, and use to pay transaction fees on the network.

Autobridging, pathfinding and liquidity all revolve around XRP first, giving it a structural advantage even as new tokens enter the ecosystem. But what about turning XRPL’s usefulness into something we can measure?

That is the tricky part. Schwartz admitted it is hard to know how much of XRP’s current value is already linked to XRPL activity, or how that connection might change in the future.

Thus, it is obvious that Ripple’s tech direction is pointing toward a more comprehensive financial stack – decentralized, tokenized and optimized for efficiency – with XRP as the core but not the limit.