On May 15, Judge Torres rejected the SEC’s request for an indicative ruling on lifting the injunction prohibiting XRP sales to institutional investors and lowering the $125 million penalty.

Since Judge Torres’ decision, XRP has fallen from $2.5712 to the May 31 low of $2.0801, highlighting investor unease over the ruling and the SEC’s silence. If Judge Torres rejects the settlement terms, Ripple may continue with its cross-appeal, and the SEC may progress with its appeal.

The SEC filed an appeal notice in October 2024, challenging the Programmatic Sales of XRP ruling. If the SEC successfully overturns the verdict, US exchanges may de-list XRP to avoid falling under the SEC’s purview. Furthermore, the SEC may disapprove XRP-spot ETF applications, a potentially significant blow to XRP’s price outlook.

Despite the ongoing Ripple case and the lingering threat of the SEC pursuing its appeal, investors remain optimistic about an XRP-spot ETF approval. According to Polymarket, the chances of the SEC approving an XRP-spot ETF by December 2025 stand at 89%, a record high.

XRP Price Outlook: Legal Moves and ETF Progress in Focus

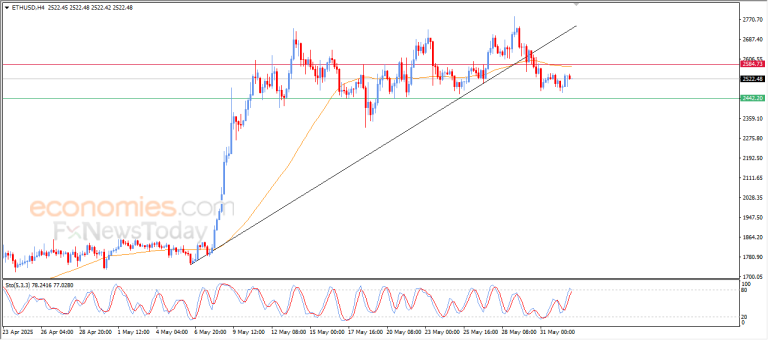

Near-term price trends hinge on Ripple case-related developments and spot ETF-related news.

Crucially, if the SEC withdraws its appeal, XRP could aim to revisit its all-time high of $3.5505, with ETF approval potentially fueling a rally toward $5. Conversely, if the court rejects a potential second settlement request, it could drop to $1.50.