This has been a good week for America’s crypto interests. The Genius Act, which legitimates a kind of cryptocurrency called stablecoins, advanced in the Senate, and on Thursday, President Trump held a gala dinner for the top 220 holders of his $Trump memecoin.

That doesn’t mean it’s been a good week for America. Stablecoins, as their name suggests, are crypto assets guaranteed by other assets like the U.S. dollar. Mr. Trump and his sons created one called USD1 through their cryptocurrency company, World Liberty Financial. Digital currencies like stablecoins are bad enough when they could potentially be used for political self-dealing. The potential problems they pose to the mainstream financial system go deeper and are much more concerning.

Their advocates claim that they will enhance U.S. financial power — Mr. Trump said that stablecoins would “expand the dominance of the U.S. dollar.”

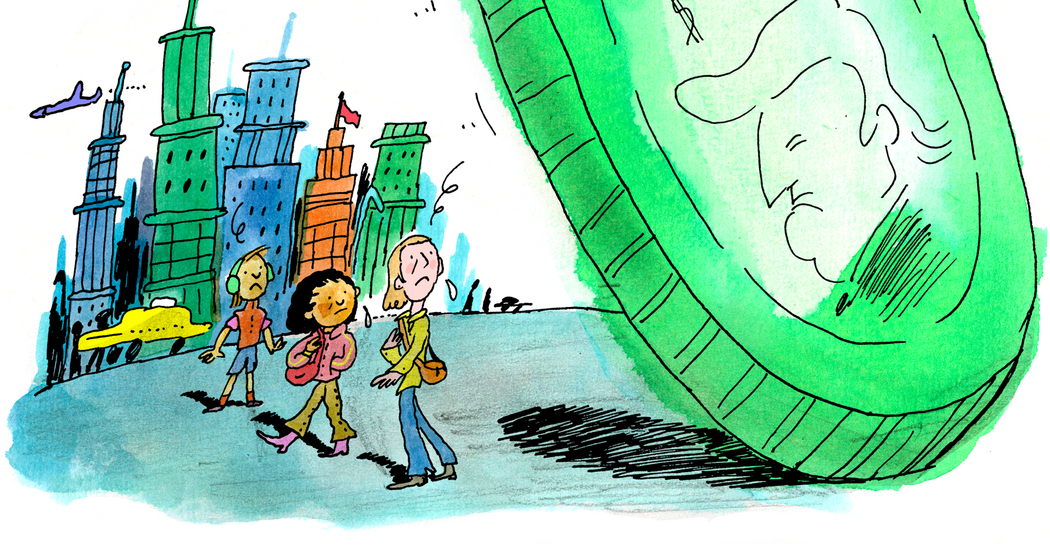

They are likely instead to undermine it, fostering scams and sanctions evasion, generating financial risk and perhaps even allowing another currency to supplant the dollar in global trade.

World Liberty Financial said it would back the digital currency using short-term U.S. Treasuries, dollar deposits and other cash equivalents. Just as the U.S. dollar anchors the global financial system, stablecoins provide a standard of value against which cryptocurrencies are measured, without the cost and inconvenience of exchanging them for real U.S. dollars in a regulated bank account.

Crypto interests want to break down the boundary between cryptocurrencies and regulated finance by integrating stablecoins into the regular U.S. financial system. That would allow them to go back and forth between the swashbuckling world of crypto, where cryptocurrencies swing wildly in value and you can gamble on the latest meme, and the rule-bound world of regulated finance, with assets and bank accounts protected by the Securities and Exchange Commission and Federal Deposit Insurance Corporation.