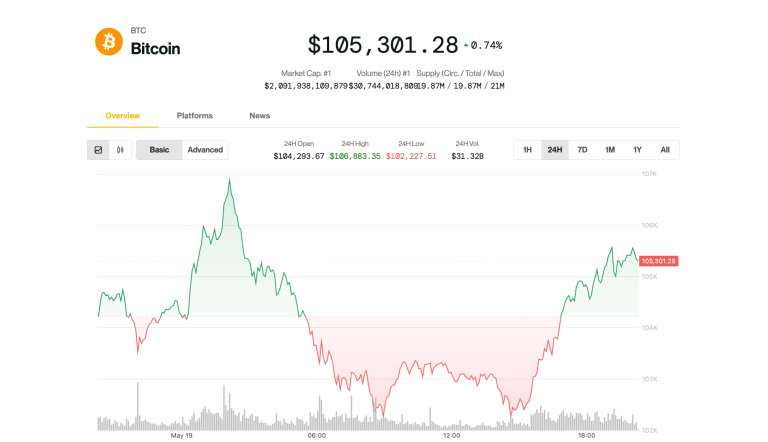

- Bitcoin finally snapped its sideways consolidation, ripping through the $107k-level

- Was this a genuine breakout – or a well-orchestrated liquidity trap?

Bitcoin [BTC] is back in the spotlight – And this time, for some pretty exciting (and risky) reasons.

The market’s already pricing in a fresh all-time high, and it’s easy to see why. After more than a week of sideways chop, BTC finally pushed past $107k, reclaiming momentum with authority.

However, this wasn’t a random impulse move. According to AMBCrypto, this move was a structurally engineered setup. Hence, the question – Will this high-stakes buildup deliver continuation or become exit liquidity?

The answer could determine whether BTC blasts through its previous all-time high or turns this pump into a prime liquidity trap.

Decoding smart money’s tactical long build on Bitcoin

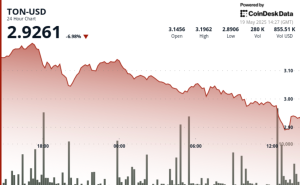

The past 48 hours have been a volatile sprint for Bitcoin holders. BTC rallied by 3.14% to close at $106,658, only to reverse course the next day with a 3.08% drop. The result? Millions flushed in liquidation bloodbaths.

Zoom in though, and the real story lies in how whales are playing this volatility.

High-leverage entities were tactically scaling into long positions, anticipating a breakout. By the time BTC touched $107k, Open Interest (OI) climbed to a new all-time high of $70 billion.

The market was officially overheated. And yet, even after BTC’s press time retrace to $103k, some whales are still doubling down. In fact, one entity notably pushed its long exposure to $460 million at 40x leverage.

The setup is now critical, especially with sentiment split between breakout and bull trap. Either we see a monster breakout or another brutal flush to cool things off.

Will the bet pay off?

At press time, Bitcoin’s Open Interest (OI) had surged by 2.93%, while Funding Rates (FR) were heavily skewed to the long side. It seemed to be a clear signal that whales have been ramping up their long exposure.

However, the $106k–$107k zone isn’t giving up without a fight. This supply wall has historically been a magnet for profit-taking by short-term holders (STHs) who tend to offload around its key resistance.

Supporting this, roughly 30,000 BTC exited STH wallets over the past 72 hours – A sign of active distribution.

Unless robust bid-side liquidity steps in to absorb this supply, the market may be vulnerable to another round of liquidity sweeps.

As such, a clean breakout to a new all-time high may be premature. Liquidity traps are forming that could pressure leveraged whale longs to lock in gains before the window closes.