12h05 ▪

3

min read ▪ by

The American exchange platform Coinbase continues its restructuring with the strategic removal of certain cryptocurrencies from its listing. These decisions come at a particularly tumultuous time for the company, just days before its historic entry into the S&P 500 index.

In Brief

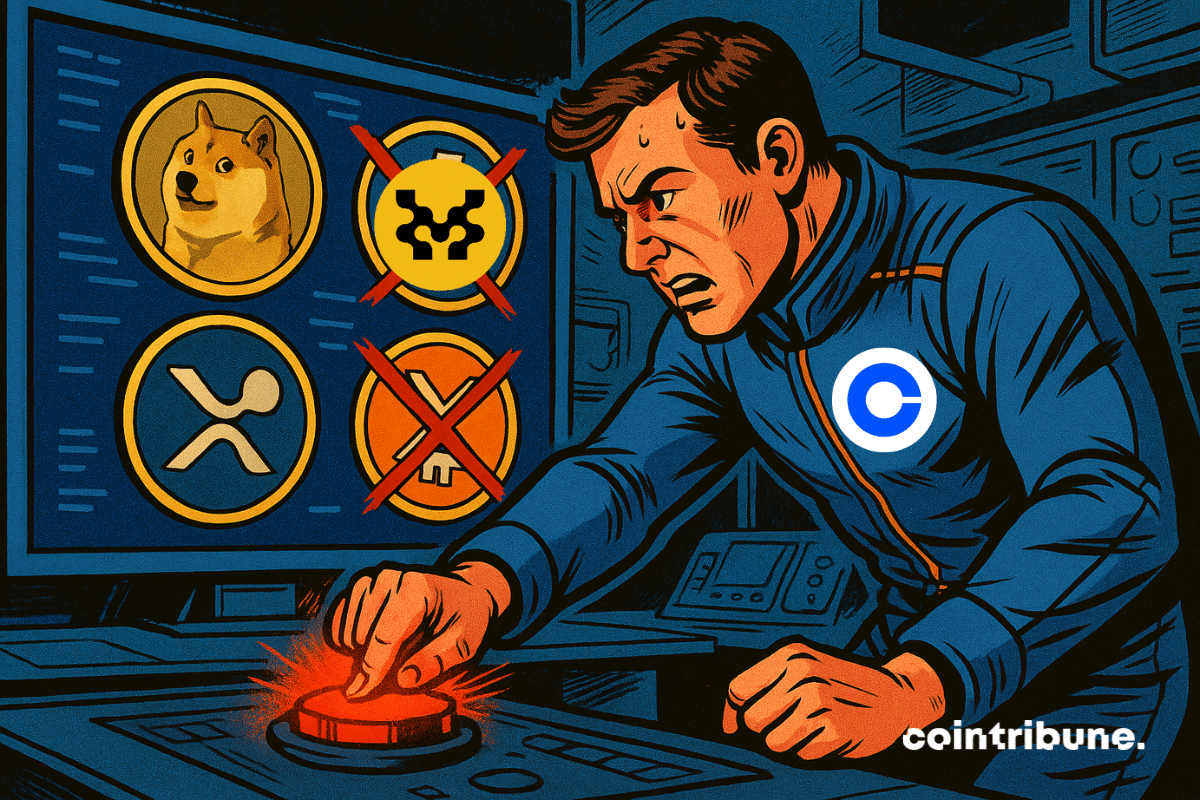

- Coinbase removes several assets from its platform, including the Movement token (MOVE), Gemini Dollar (GUSD), and GYEN.

- The platform plans the upcoming launch of wrapped versions of major cryptocurrencies (cbADA, cbDOGE, cbLTC, cbXRP).

- Coinbase expands its territorial offering by making Coinbase Wrapped Staked Ethereum (CBETH) accessible to residents of the state of New York.

Coinbase removes 3 cryptocurrencies from its platform

Coinbase officially announced via its Twitter account the deactivation of trading for the Movement (MOVE) token on its platform. This decision follows a regular evaluation of the assets offered according to the company’s strict listing standards.

This removal is not an isolated case. The platform also suspended trading for Gemini Dollar (GUSD) and GYEN on May 7. These adjustments demonstrate Coinbase’s ongoing vigilance regarding the quality of cryptocurrencies offered to its users.

Despite these removals, Coinbase reassured its customers: funds remain fully secured and users retain the ability to withdraw their MOVE tokens at any time.

Alongside these restrictions, the company is expanding its offering by making Coinbase Wrapped Staked Ethereum (CBETH) accessible to New York residents, a market previously subject to significant regulatory limitations.

New Yorkers can now use CBETH both on the web platform and on Coinbase’s iOS and Android mobile apps. This expansion strengthens the company’s presence in a strategic financial market while broadening access to Ethereum staking services.

In its drive for innovation, Coinbase also announced the upcoming arrival of wrapped versions of several major cryptocurrencies — Cardano (cbADA), Dogecoin (cbDOGE), Litecoin (cbLTC), and XRP (cbXRP). Exact launch dates remain to be confirmed.

A Pivotal Period Marked by Major Security Challenges

These adjustments come at a particularly sensitive time for Coinbase. The company recently revealed that it was the victim of a significant security breach.

Corrupt foreign support agents leaked sensitive user data. This incident could cost the platform up to 400 million dollars, according to internal estimates.

Fortunately, no funds, passwords, or private keys were exposed during this attack, and Coinbase Prime accounts remained intact. However, the stolen information allowed attackers to conduct targeted social engineering operations against certain users.

This series of events occurs as Coinbase prepares to achieve a historic milestone by becoming the first crypto company to join the S&P 500 index, a milestone marking the gradual integration of the crypto sector into traditional finance.

In summary, Coinbase is going through a pivotal period where every strategic decision matters. The targeted removal of certain cryptocurrencies may well reflect a desire to consolidate its reputation before joining one of the world’s most prestigious stock indices.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j’aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l’outil qui peut rendre cela possible.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.