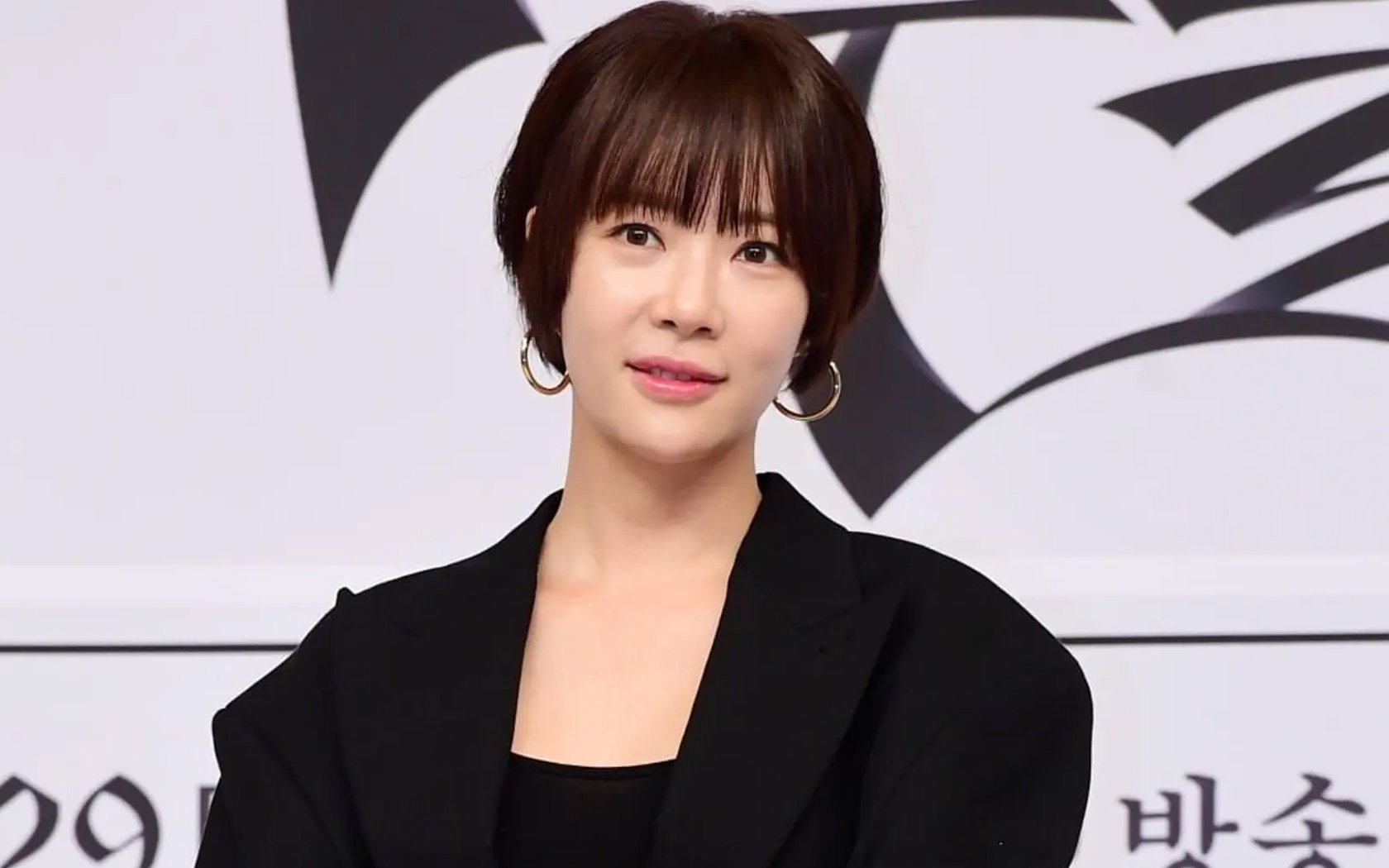

Hwang Jung Eum has stood trial on charges of embezzling company funds from an agency she effectively owns and investing them in cryptocurrency.

On May 15, Judge Lim Jae Nam of the 2nd Criminal Division at the Jeju District Court held the first trial for actress Hwang Jung Eum (age 41), who has been indicted without detention on charges of violating the Act on the Aggravated Punishment of Specific Economic Crimes (embezzlement).

According to the indictment, Hwang is accused of embezzling approximately 4.34 billion KRW (about 3.1 million USD) in company funds up until December 2022. This includes 700 million KRW (about 520,000 USD) she received around early 2022 under the pretense of an advance payment, which she allegedly used to invest in cryptocurrency.

Hwang Jung Eum was accused of embezzling approximately 4.34 billion KRW (about 3.1 million USD) from her management agency, which she is known to own 100% through a 가족법인 family corporation). Even if Hwang Jung Eum owns 100% of the company, because it’s structured as a family corporation, Korean law still recognizes the business as a completely separate legal entity. This means she cannot treat company funds as her personal money. While paying herself a salary, receiving dividends, or covering legitimate business expenses are allowed, using company funds for personal purchases, such as a car, luxury shopping, or cryptocurrency investments, are seen as a breach of fiduciary duty and can trigger tax audits, penalties, or embezzlement charges.

Hwang Jung Eum’s legal team admitted to the charges during the trial.

Korean netizens were shocked by the amount of money Hwang Jung Eum embezzled and invested in cryptocurrency. They commented:

“She probably lost her mind and thought, ‘I’ll just grow the money and put it back later’…”

“She told people not to worry because she had a lot of money, and yet she even took out a loan. Sigh.”

“If she owns 100% of a one-person agency, maybe she thought it was just her own money and used it as such.”

“Seriously…”

“Crypto – that’s not investing. It’s just gambling, lol.”

“Whoa.”

“Wow… I was nervous just putting in 15 million KRW (10,723 USD) of my own money, and here celebrities really have a different mindset…”

“Shocking that the embezzlement was on that big of a scale.”

“Maybe I just don’t get it, but weren’t those celebrities previously fined because one-person corporations = individuals? So they had to pay personal income tax, not corporate tax. Why isn’t this being treated as personal, then?”

“Should’ve at least asked an accounting firm. Even if it’s just one person, it’s still a corporation.”

“It’s not a one-person corporation, it’s a family corporation. The article says she owns 100%, but the structure isn’t a one-person corp, it’s setup as a family corp, which is legally different. Family corporations divide dividend income among family members to reduce the income tax burden. It also helps reduce capital gains and inheritance taxes, and has greater exemption benefits for gift taxes.”

“That’s crazy.”

“Honestly, when I see people investing company funds into crypto these days, I pretty much assume they’re fraudsters. What legitimate business owner risks company money on something as volatile as crypto?”

“Embezzlement on crypto… yikes.”

“Oh dear.”

“Did she lose all that money?”

“Why did she make such a choice?”