On May 12, MicroStrategy (Nasdaq: MSTR) founder and executive chairman Michael Saylor announced that the firm acquired 13,390 Bitcoin for approximately $1.34 billion during May 5-11.

MicroStrategy, now known as Strategy, made the Bitcoin acquisition with proceeds from the sale of Common A (MSTR) and 8% Series A Perpetual Strike Preferred (STRK) stocks.

The latest announcement comes within a few hours of the U.S. and China striking a landmark trade deal and slashing tariff rates on each other.

The company’s stock soared to $423.8 in pre-market hours in the wake of these announcements. The stock has surged more than 10% over the last seven days.

Strategy that began acquiring Bitcoin in 2020 is the world’s largest corporate holder of the world’s largest cryptocurrency. In fact, Bitcoin is the firm’s “primary treasury reserve asset.”

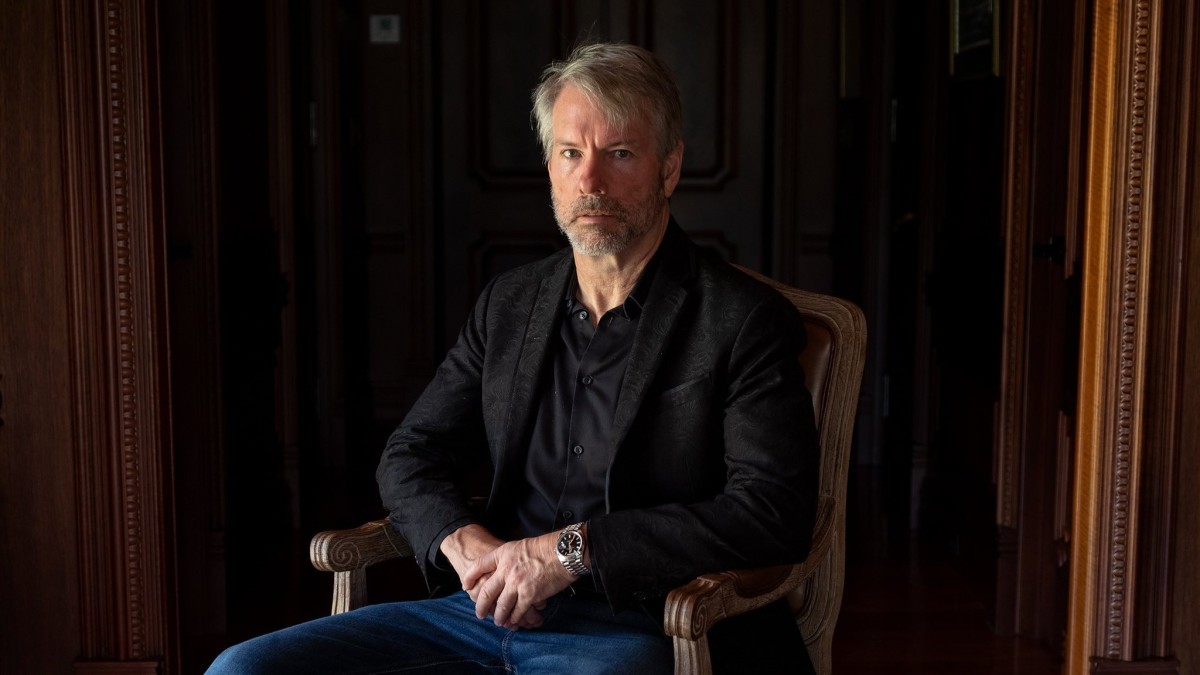

The firm’s founder, Saylor, is well-known for his bullish outlook on Bitcoin, predicting that the coin will hit $13 million by 2045.

As of May 11, the firm holds 568,840 BTC acquired for $39.4 billion that is worth $59 billion at the time of writing. In fact, it has bought over 40,000 BTC during the current quarter.

Strategy’s aggressive Bitcoin acquisition has inspired several companies, such as Metaplanet, Semler Scientific, etc., to add BTC to their balance sheets.

As per Kraken’s price feed, Bitcoin was trading at $104,014 at press time, up 10% a week. The asset is nearly 5% lower than its all-time high (ATH) of $108,786 that it hit on Jan. 20.