13h30 ▪

4

min read ▪ by

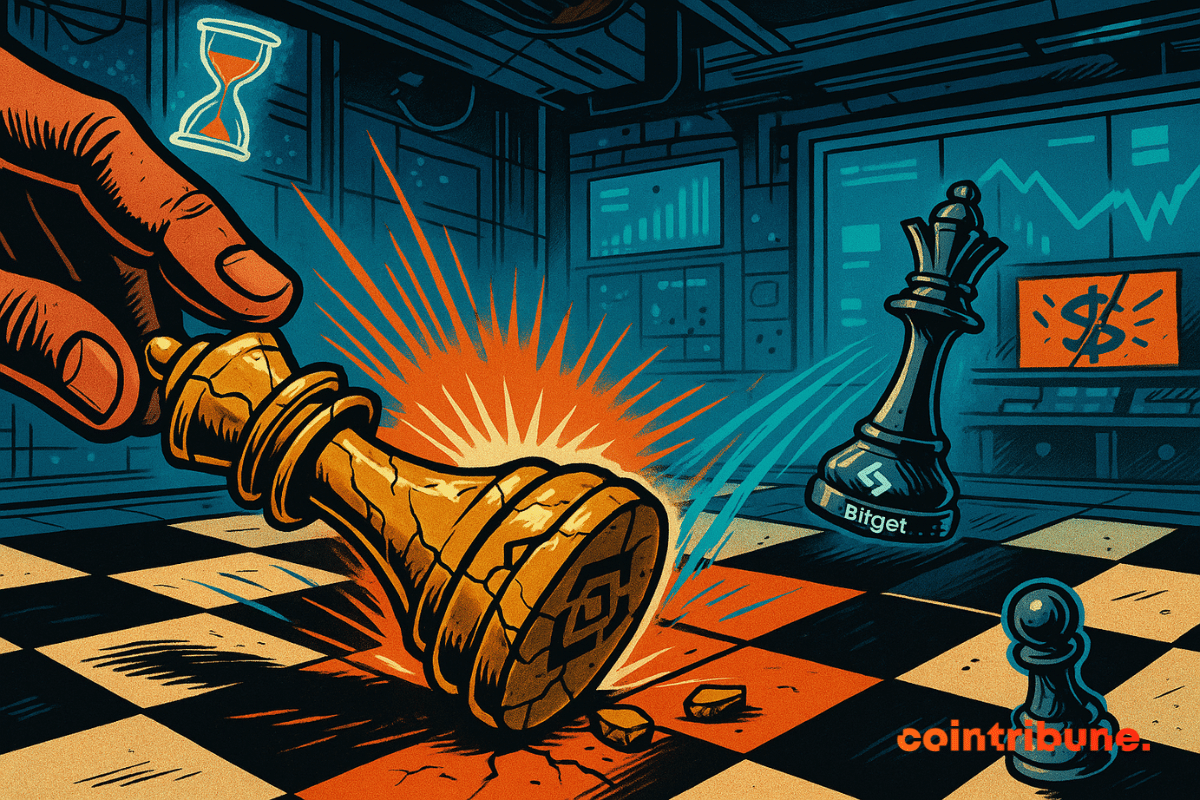

When a giant falters, the entire crypto ecosystem holds its breath. In April 2025, CoinGecko published an unfiltered snapshot of the centralized exchange (CEX) market, revealing an unprecedented shift in the power dynamics. While Binance remains at the top, its dominance is eroding amid a rapidly reconfiguring landscape of players. The spectacular moves by Gate.io and Bitget, coupled with a global contraction in volumes, raise questions about the sector’s evolution.

In brief

- Binance maintains its first place, despite an 18% decrease in its trading volume, which fell below 500 billion dollars for the first time since October 2024.

- Gate.io makes a spectacular advance and takes second place, with a 14.4% growth in April.

- Bitget experiences a meteoric rise, doubling its market share and reaching third position.

- Despite the overall decline, the performances of Gate.io and Bitget highlight a challenge to the established order in the market.

A shaken podium: towards a new order among CEXs?

Binance retains its status as the world number one with a market share of 38% in April 2025. However, this figure disguises a more nuanced reality:

- The platform’s spot trading volume fell to 482.6 billion dollars, recording a drop of -18% compared to March;

- It is the first time since October 2024 that Binance has fallen below the symbolic 500 billion threshold.

Meanwhile, Gate.io climbed to second place with a 9% market share, up +14.4% month-on-month, totaling 113.7 billion dollars.

CoinGecko specifies that “Gate.io was the only exchange platform to register double-digit growth”. It now surpasses Crypto.com, which has been continuously declining since February.

This upheaval at the top of the ranking is complemented by the rise of Bitget, now third with 92 billion dollars in volume and a market share of 7.2%. Bitget started the year with only 4.6% share, but its steady progression has allowed it to overtake historical competitors.

Note that concentration remains strong. Exchanges ranked from second to tenth place each hold a market share ranging from 5% to 9%. In other words, the market is fragmenting but remains dominated by a few well-identified players.

Global tension dynamics in the first quarter

Looking beyond April, first quarter 2025 data show a more concerning trend: a massive contraction in volumes across the main exchanges.

CoinGecko specifies that “nine of the top ten exchanges saw their transaction volumes drop in the first quarter of 2025,” with eight experiencing double-digit declines. Binance, despite holding the first place, saw its quarterly volumes drop by -15.7%, settling at 2 trillion dollars, out of a total of 5.4 trillion for the top 10. Gate.io and Bitget are not exempt from this trend, with respective declines of 12.6% and 13.2%. The most severe case remains Upbit, whose volumes have melted by -34%.

This widespread decline reflects a retreat in liquidity and engagement in spot markets, despite a more favorable macro context with the crypto market recovery. The contrast between monthly growths (Gate.io, Bitget) and quarterly regressions suggests increased volatility and opportunistic volume movements. Moreover, CoinGecko reminds that Bitget was only the ninth largest platform by volume in the first quarter, despite being third in April, proving a very recent rise.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d’une certification consultant blockchain délivrée par Alyra, j’ai rejoint l’aventure Cointribune en 2019.

Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l’économie, j’ai pris l’engagement de sensibiliser et d’informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu’elle offre. Je m’efforce chaque jour de fournir une analyse objective de l’actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.